Academy Sports trades at $57 and has moved in lockstep with the market. Its shares have returned 7.4% over the last six months while the S&P 500 has gained 2.5%.

Is there a buying opportunity in Academy Sports, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We're sitting this one out for now. Here are three reasons why you should be careful with ASO and a stock we'd rather own.

Why Is Academy Sports Not Exciting?

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

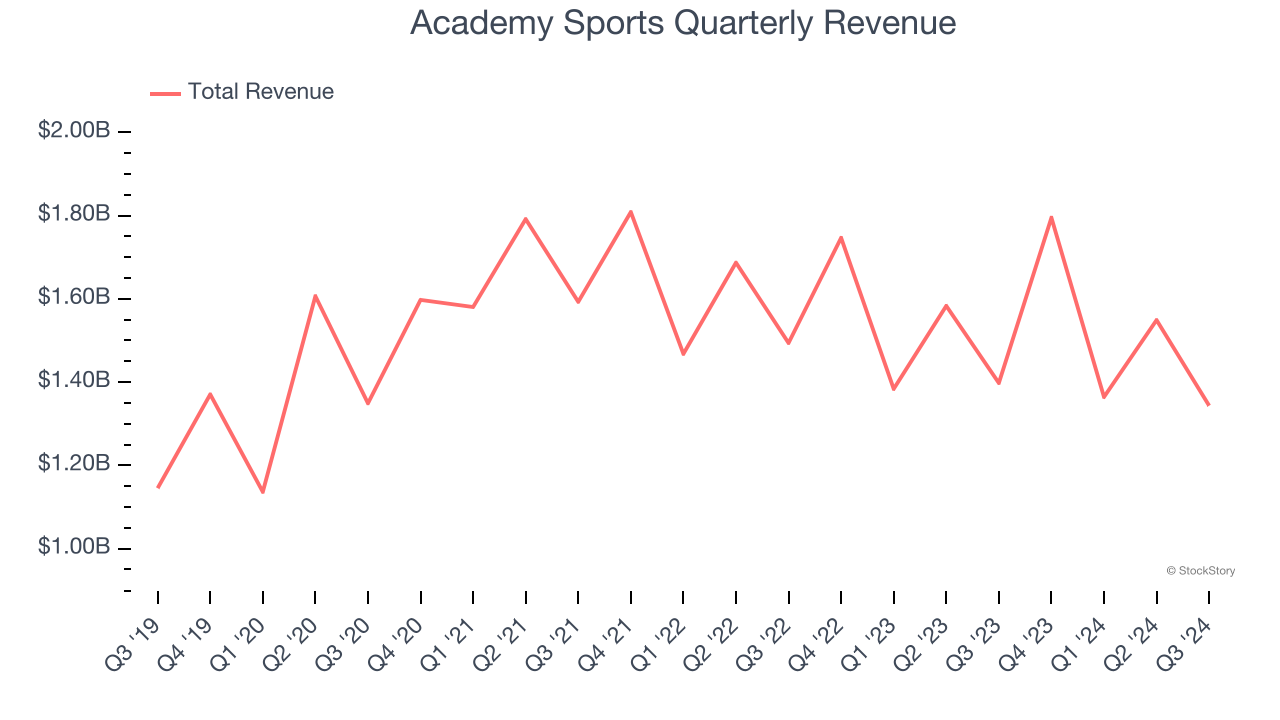

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Academy Sports’s 4.7% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer retail sector.

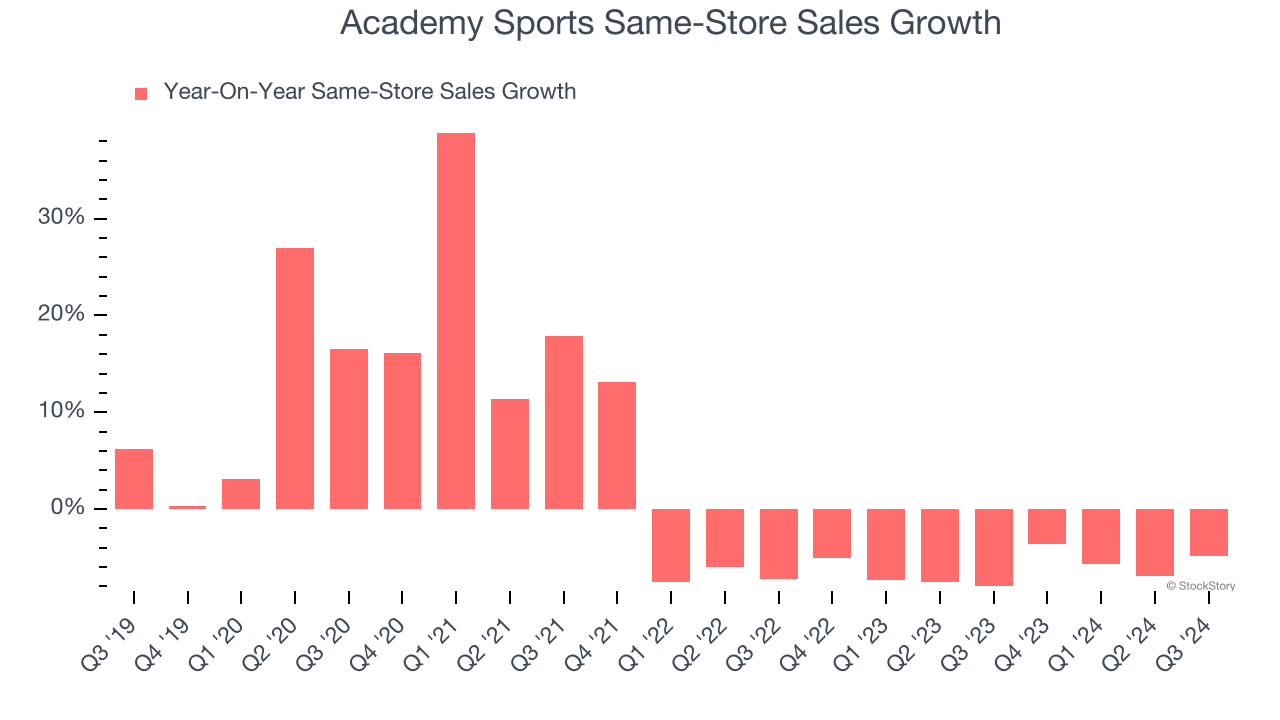

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Academy Sports’s demand has been shrinking over the last two years as its same-store sales have averaged 6.1% annual declines.

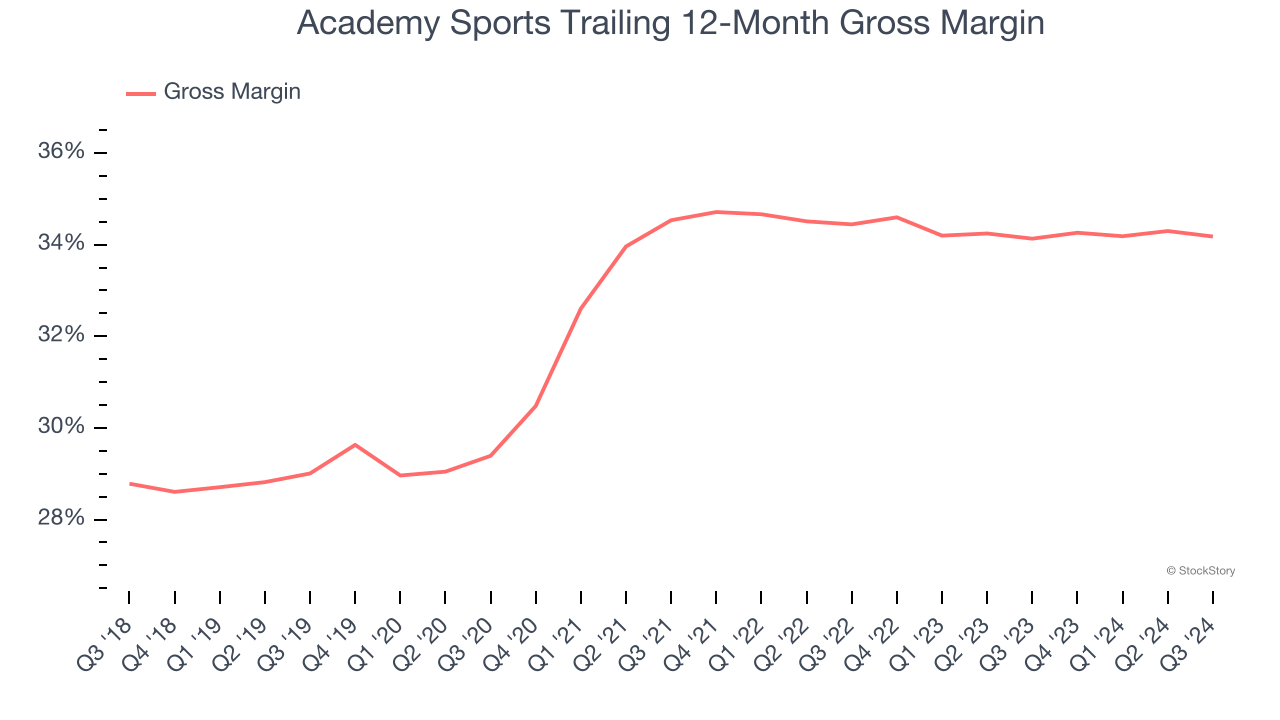

3. Low Gross Margin Hinders Flexibility

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Academy Sports’s gross margin is slightly below the average retailer, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 34.2% gross margin over the last two years. Said differently, Academy Sports had to pay a chunky $65.85 to its suppliers for every $100 in revenue.

Final Judgment

Academy Sports isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 8.9× forward price-to-earnings (or $57 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Academy Sports

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.