What a brutal six months it’s been for Skillz. The stock has dropped 24.3% and now trades at $5.10, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Skillz, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even though the stock has become cheaper, we're swiping left on Skillz for now. Here are three reasons why SKLZ doesn't excite us and a stock we'd rather own.

Why Do We Think Skillz Will Underperform?

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

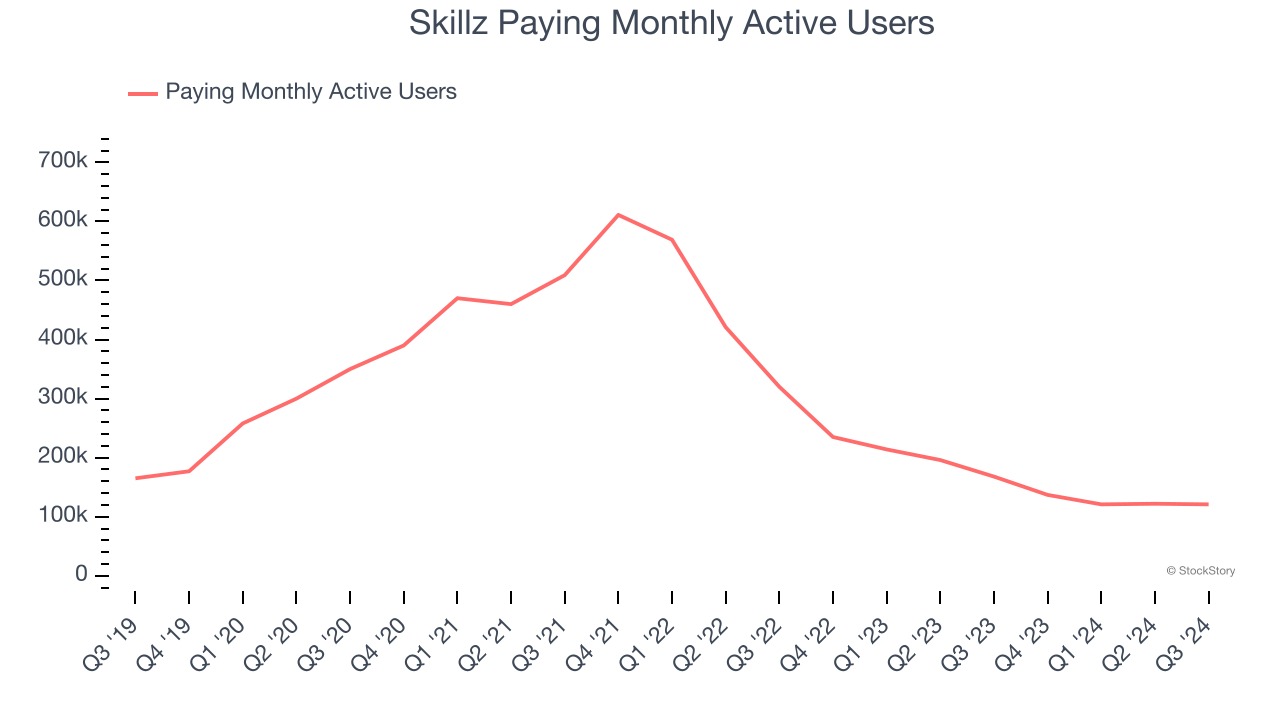

1. Declining Paying Monthly Active Users Reflect Product Weakness

As a video gaming company, Skillz generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Skillz struggled to engage its paying monthly active users over the last two years as they have declined by 47% annually to 121,000 in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Skillz wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

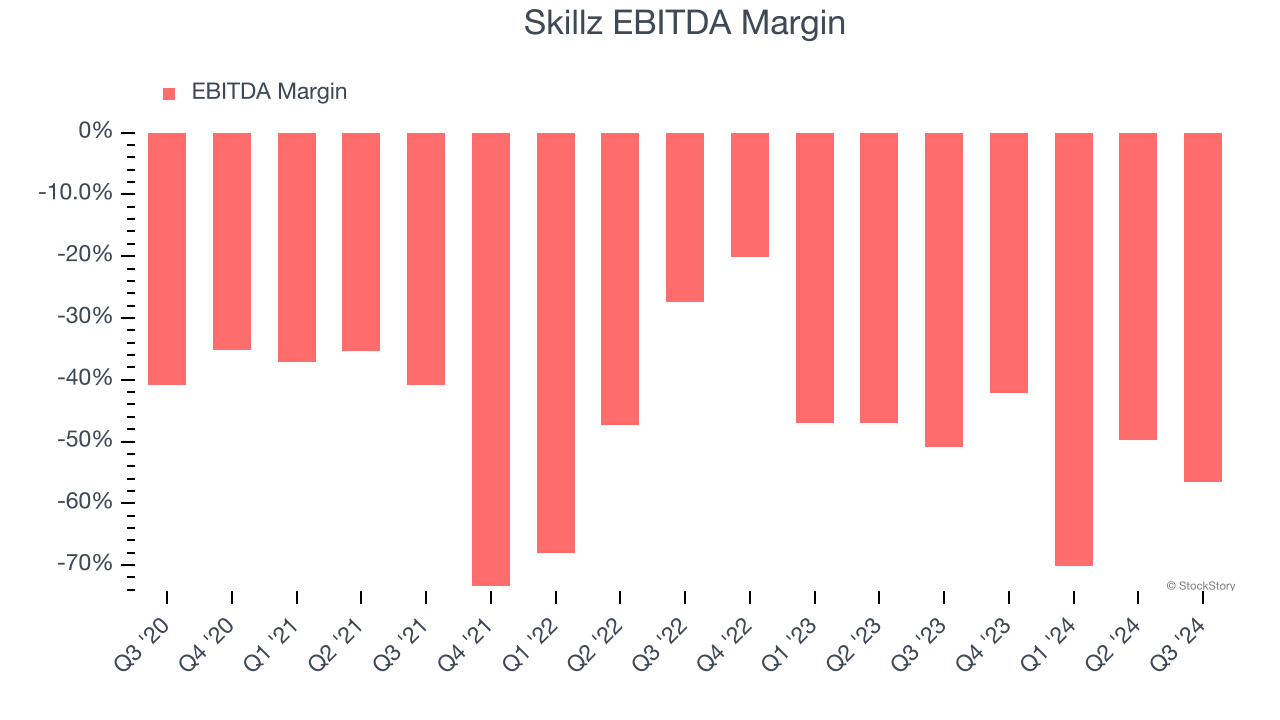

2. EBITDA Margin Falling

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Looking at the trend in its profitability, Skillz’s EBITDA margin decreased by 16.8 percentage points over the last few years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers. Its EBITDA margin for the trailing 12 months was negative 54.2%.

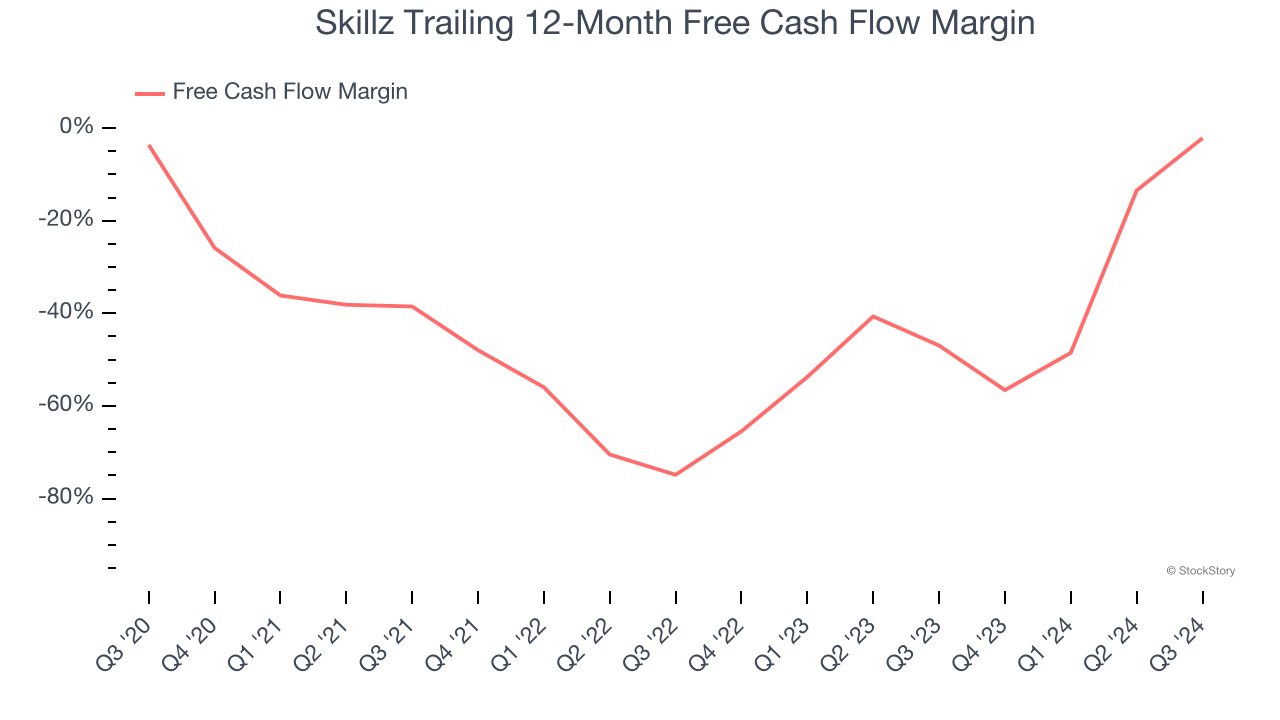

3. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Skillz’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 29.8%, meaning it lit $29.80 of cash on fire for every $100 in revenue.

Final Judgment

Skillz falls short of our quality standards. Following the recent decline, the stock trades at 0.9× forward price-to-gross profit (or $5.10 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Skillz

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.