Shareholders of Wingstop would probably like to forget the past six months even happened. The stock dropped 28.9% and now trades at $274.70. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy WING? Find out in our full research report, it’s free.

Why Is WING a Good Business?

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

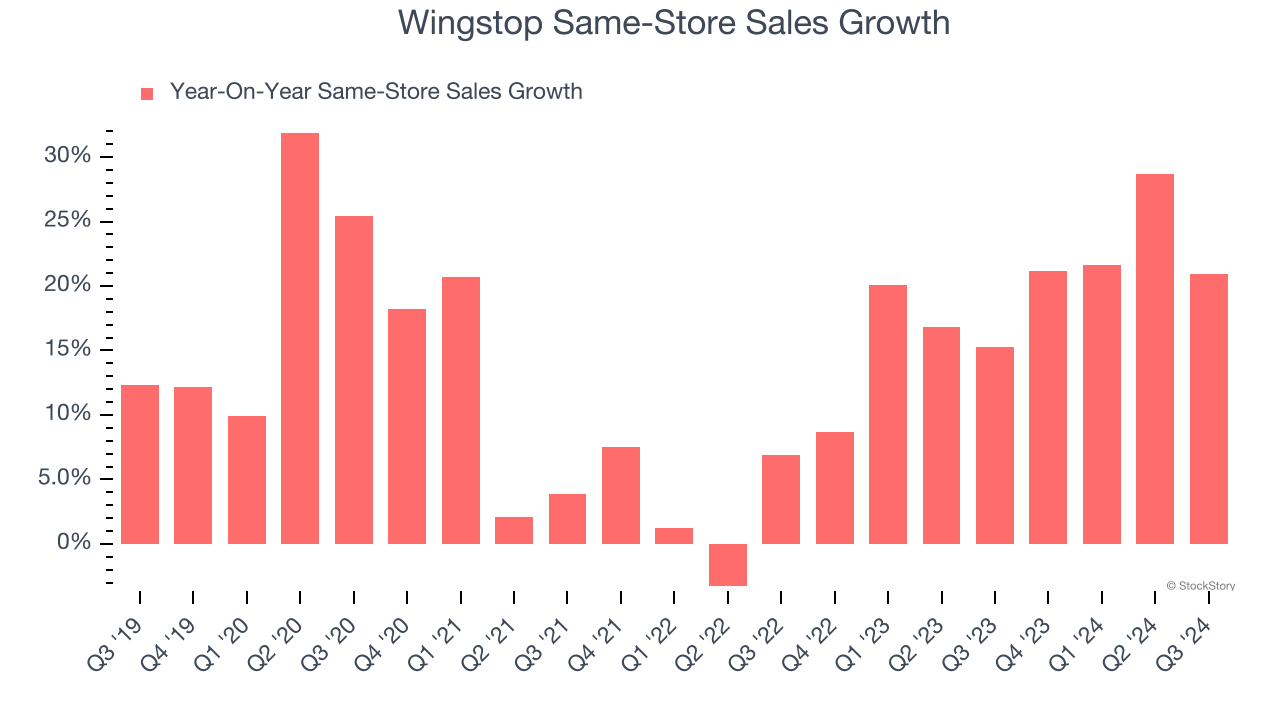

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

Wingstop has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 19.2%.

2. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Wingstop has been a well-oiled machine over the last two years. It demonstrated elite profitability for a restaurant business, boasting an average operating margin of 25.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

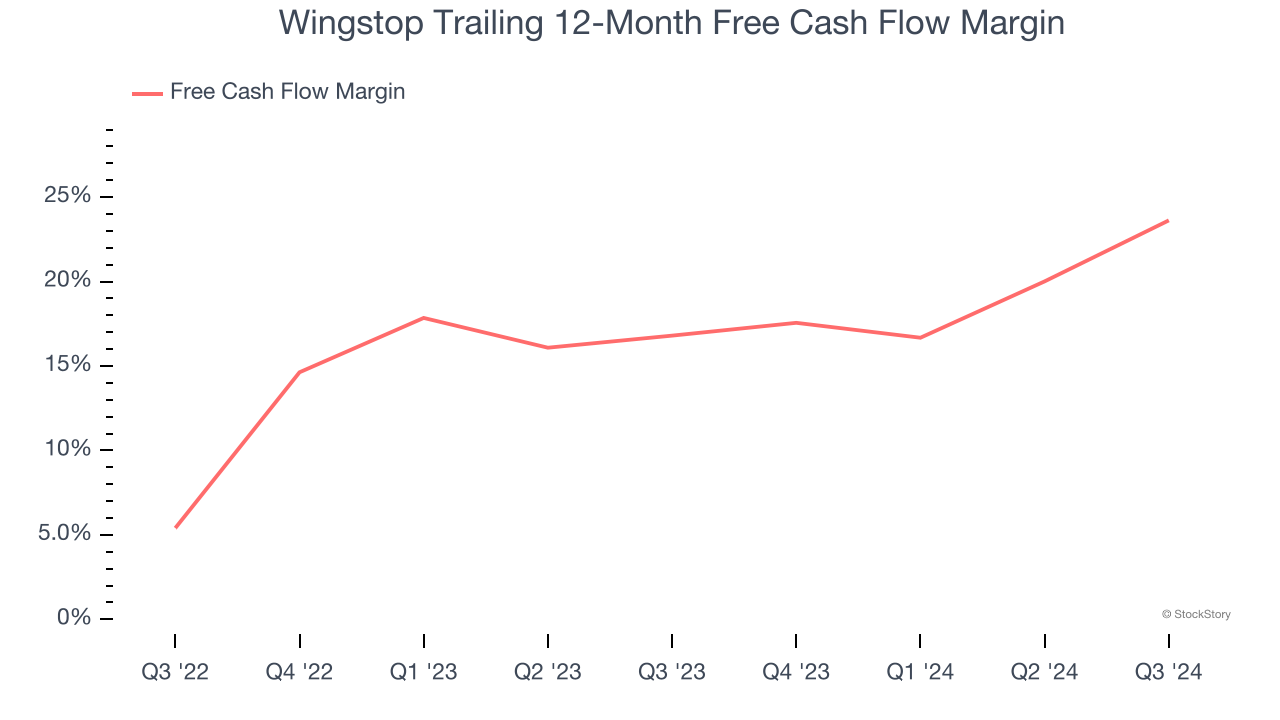

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Wingstop has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 20.7% over the last two years.

Final Judgment

These are just a few reasons why Wingstop ranks near the top of our list. With the recent decline, the stock trades at 62.7× forward price-to-earnings (or $274.70 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Wingstop

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.