Over the last six months, DistributionNOW’s shares have sunk to $12.83, producing a disappointing 7.3% loss - a stark contrast to the S&P 500’s 2.5% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy DistributionNOW, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than DNOW and a stock we'd rather own.

Why Is DistributionNOW Not Exciting?

Spun off from National Oilwell Varco, DistributionNOW (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

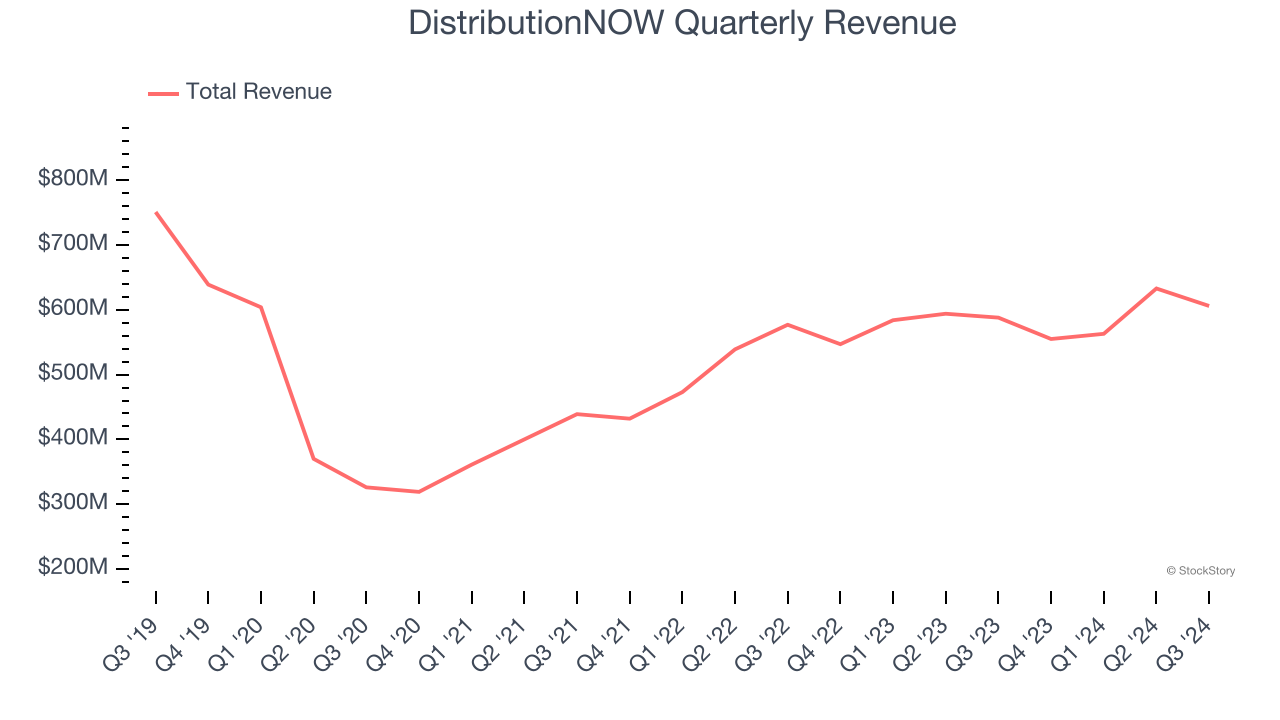

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. DistributionNOW’s demand was weak over the last five years as its sales fell at a 5.2% annual rate. This fell short of our benchmarks and signals it’s a lower quality business.

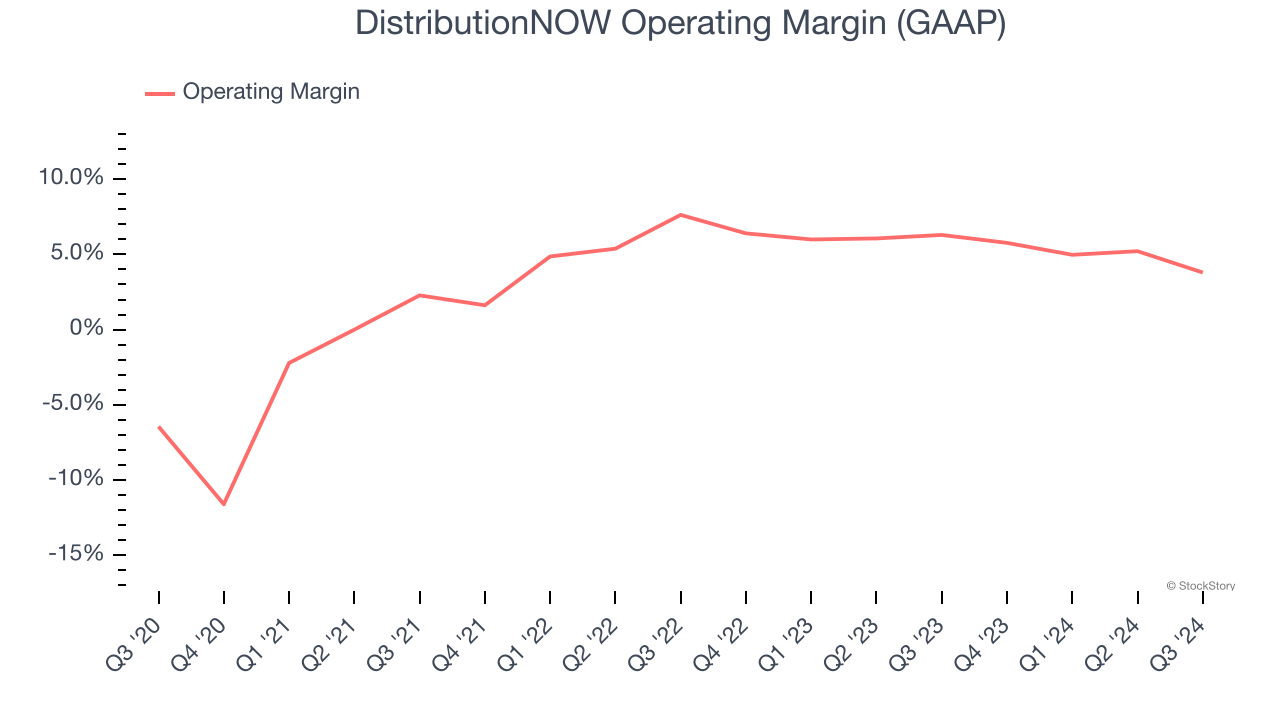

2. Operating Losses Sound the Alarms

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although DistributionNOW was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

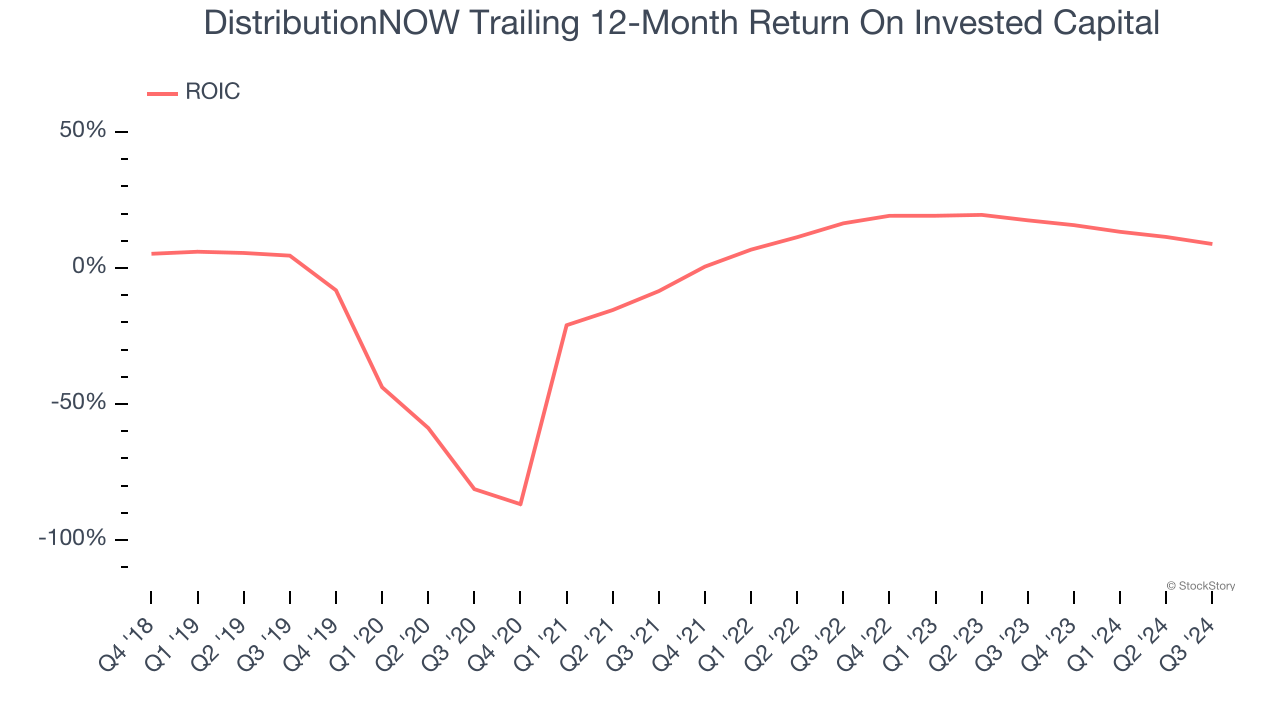

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

DistributionNOW’s five-year average ROIC was negative 9.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

Final Judgment

DistributionNOW’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 15× forward price-to-earnings (or $12.83 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. Let us point you toward Meta, a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of DistributionNOW

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.