McDonald's has had an impressive run over the past six months as its shares have beaten the S&P 500 by 9.5%. The stock now trades at $281.69, marking a 12% gain. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy MCD? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does MCD Stock Spark Debate?

With nicknames spanning Mickey D's, McDanks, and our favorite, Mackers, McDonald’s (NYSE:MCD) is a fast-food behemoth known for its convenience and broken ice cream machines.

Two Positive Attributes:

1. Surging Same-Store Sales Show Increasing Demand

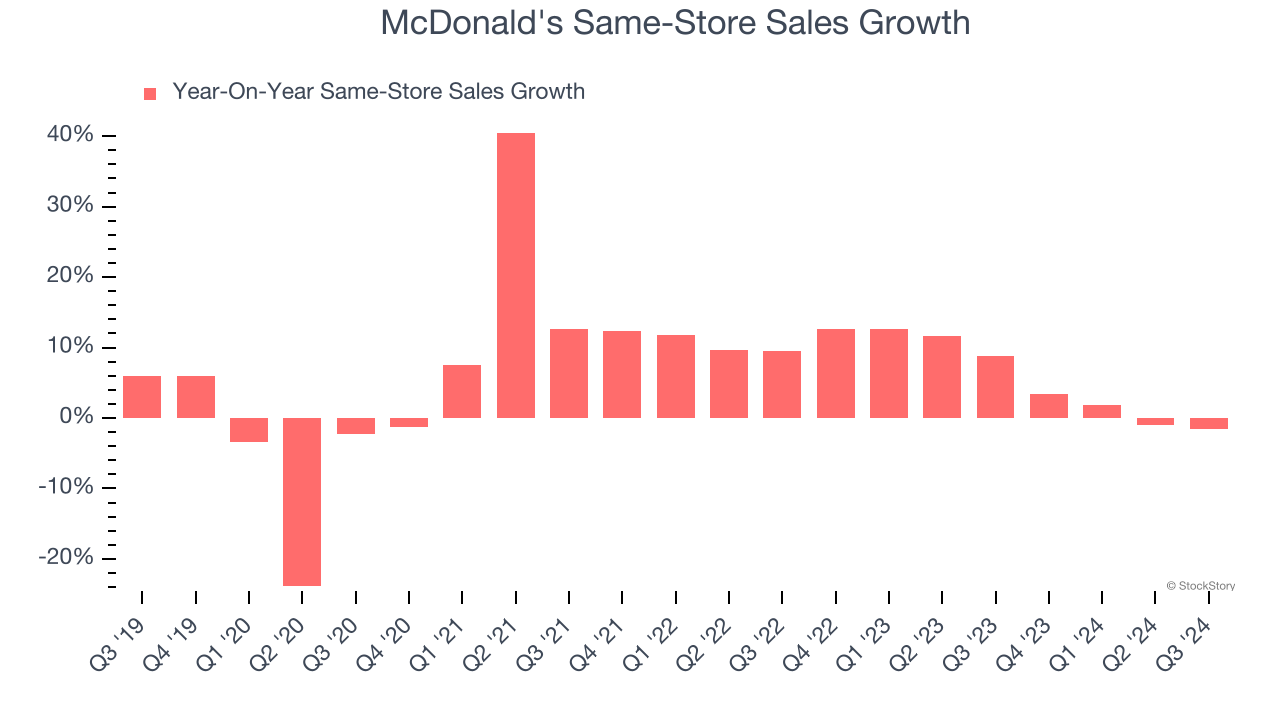

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

McDonald's has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6.1%.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

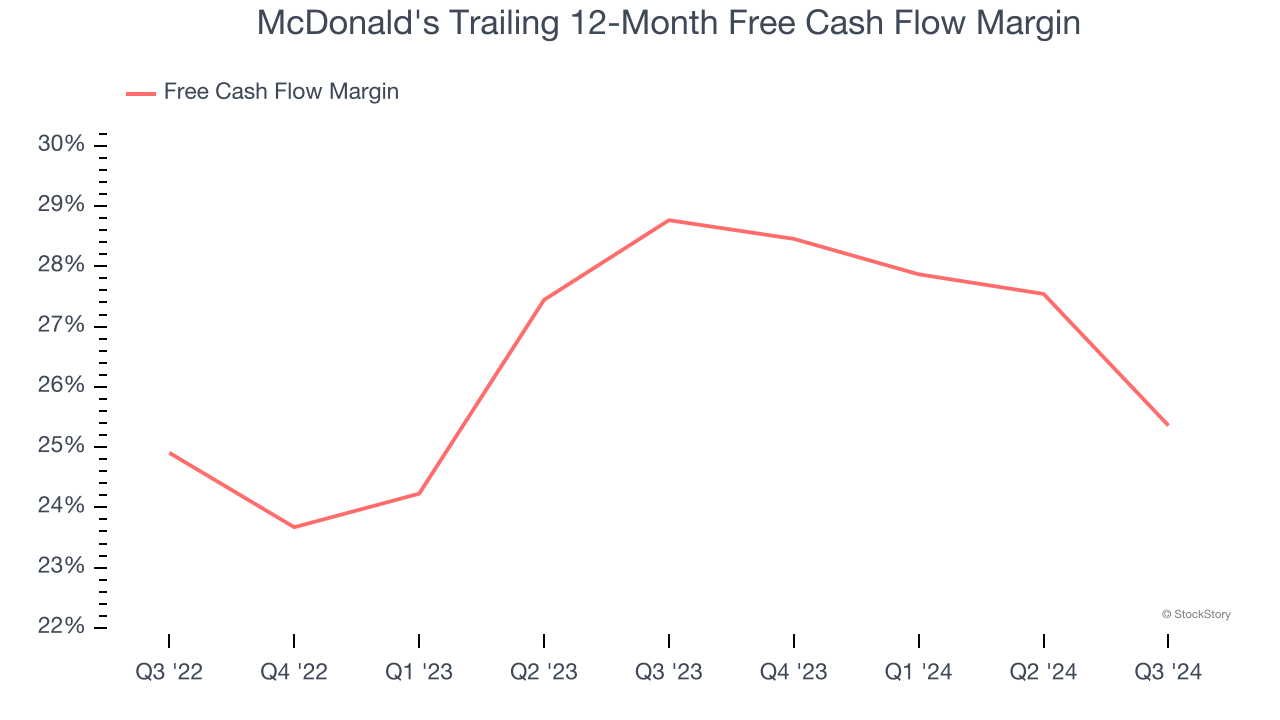

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

McDonald's has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 27% over the last two years.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

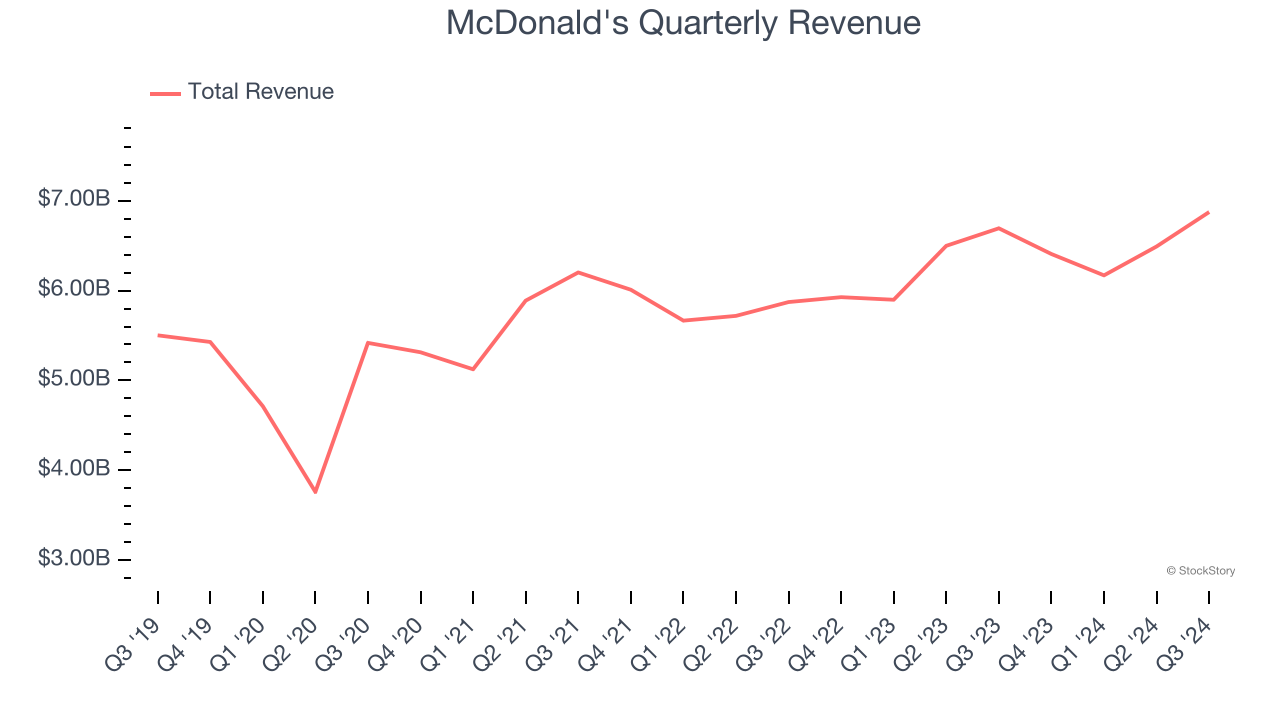

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, McDonald's grew its sales at a sluggish 4.2% compounded annual growth rate. This was below our standard for the restaurant sector.

Final Judgment

McDonald’s merits more than compensate for its flaws, and with its shares beating the market recently, the stock trades at 23× forward price-to-earnings (or $281.69 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than McDonald's

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.