Chipotle currently trades at $57.40 per share and has shown little upside over the past six months, posting a middling return of 1.4%. This is close to the S&P 500’s 4.2% gain during that period.

Is now the time to buy CMG? Find out in our full research report, it’s free.

Why Are We Positive On Chipotle?

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE:CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

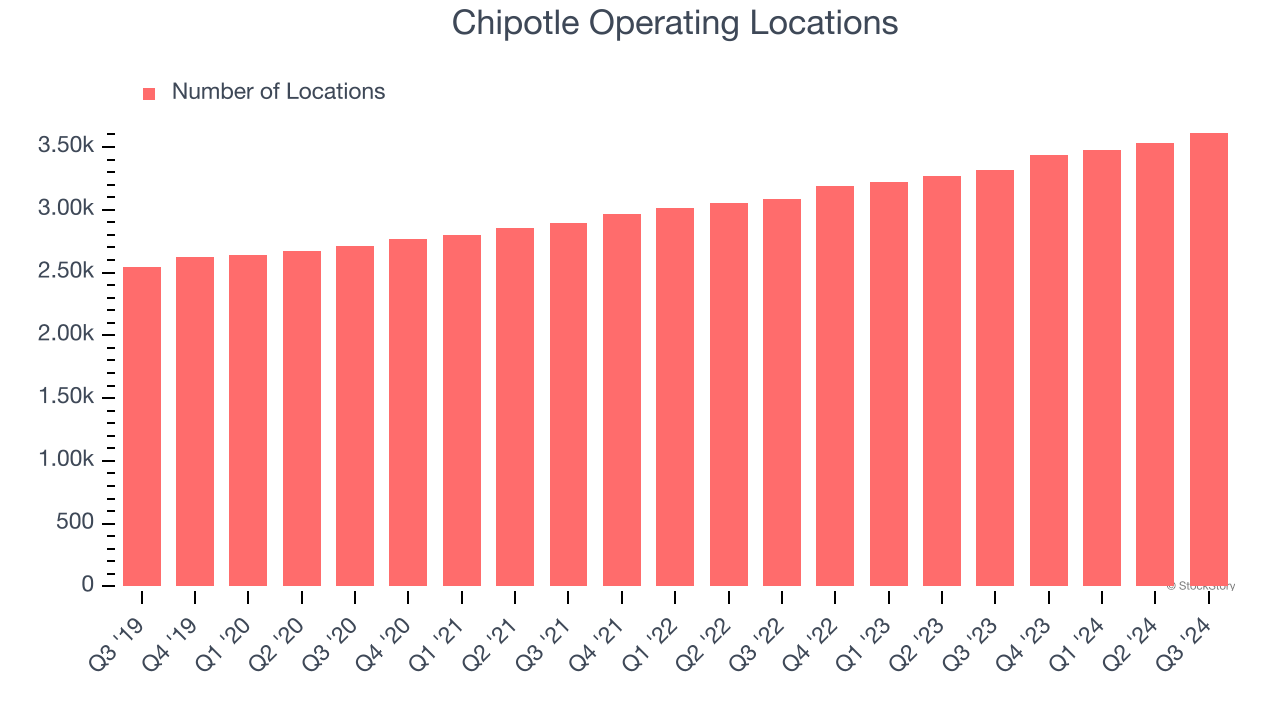

1. New Restaurants Opening at Breakneck Speed

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Chipotle operated 3,615 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years by averaging 7.7% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

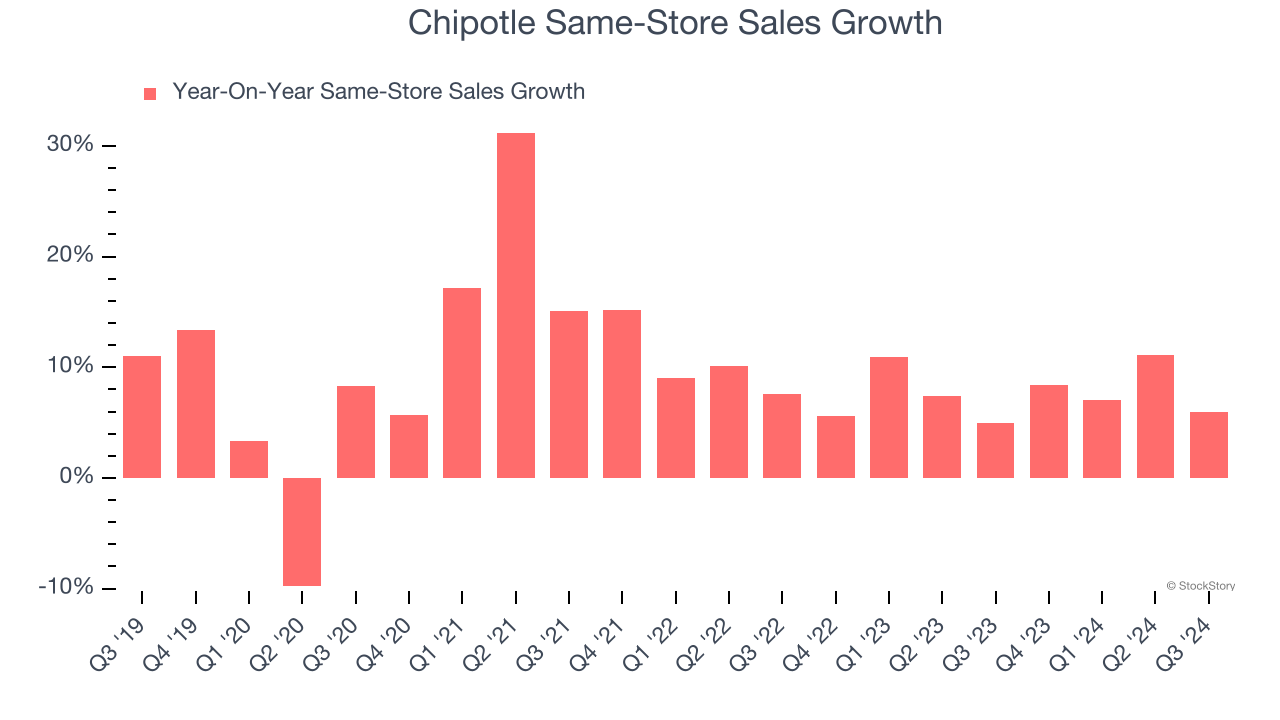

2. Surging Same-Store Sales Show Increasing Demand

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Chipotle has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 7.7%.

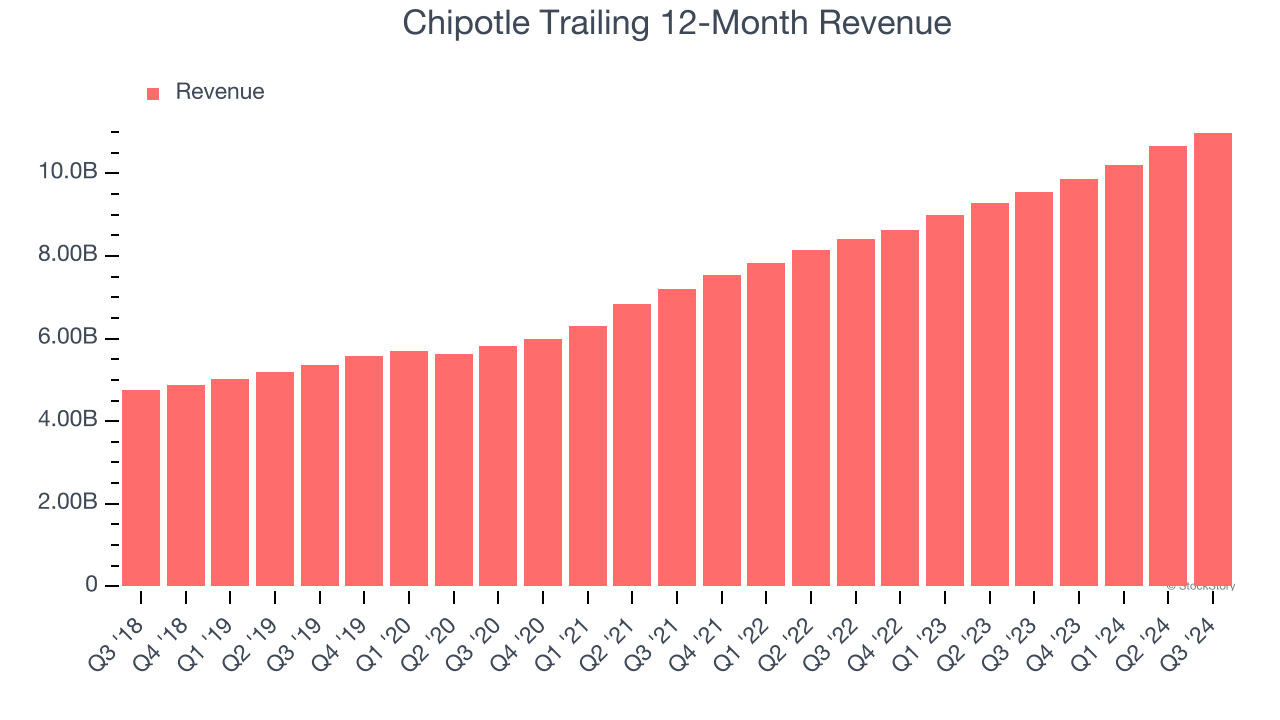

3. Economies of Scale Give It Negotiating Leverage with Suppliers

Chipotle is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost.

Final Judgment

These are just a few reasons why we're bullish on Chipotle, but at $57.40 per share (or 45.6× forward price-to-earnings), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Chipotle

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.