Online money transfer platform Remitly (NASDAQ:RELY) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 32.9% year on year to $351.9 million. The company expects next quarter’s revenue to be around $346.5 million, close to analysts’ estimates. Its GAAP loss of $0.03 per share was 67.6% above analysts’ consensus estimates.

Is now the time to buy Remitly? Find out by accessing our full research report, it’s free.

Remitly (RELY) Q4 CY2024 Highlights:

- Revenue: $351.9 million vs analyst estimates of $343.7 million (32.9% year-on-year growth, 2.4% beat)

- EPS (GAAP): -$0.03 vs analyst estimates of -$0.09 (67.6% beat)

- Adjusted EBITDA: $43.69 million vs analyst estimates of $21.35 million (12.4% margin, significant beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.57 billion at the midpoint, beating analyst estimates by 1% and implying 24.4% growth (vs 33.8% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $190 million at the midpoint, above analyst estimates of $176.6 million

- Operating Margin: -1.1%, up from -11.7% in the same quarter last year

- Free Cash Flow Margin: 14.3%, down from 43.3% in the previous quarter

- Active Customers: 7.8 million, up 1.89 million year on year

- Market Capitalization: $4.96 billion

“We delivered an exceptional fourth quarter and full year, exceeding expectations, as our product strength and customer loyalty drove durable growth and improving profitability,” said Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

Company Overview

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

Financial Technology

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

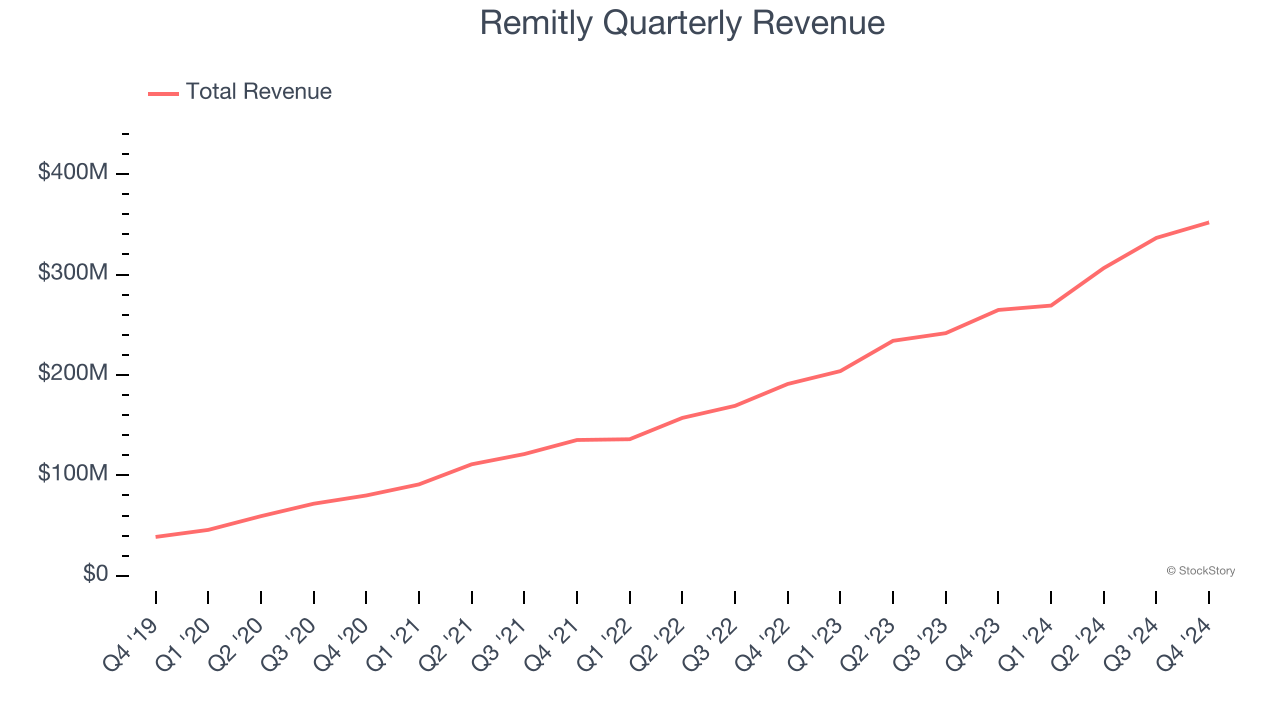

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Remitly’s sales grew at an incredible 40.2% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Remitly reported wonderful year-on-year revenue growth of 32.9%, and its $351.9 million of revenue exceeded Wall Street’s estimates by 2.4%. Company management is currently guiding for a 28.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 23.5% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and implies the market is factoring in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

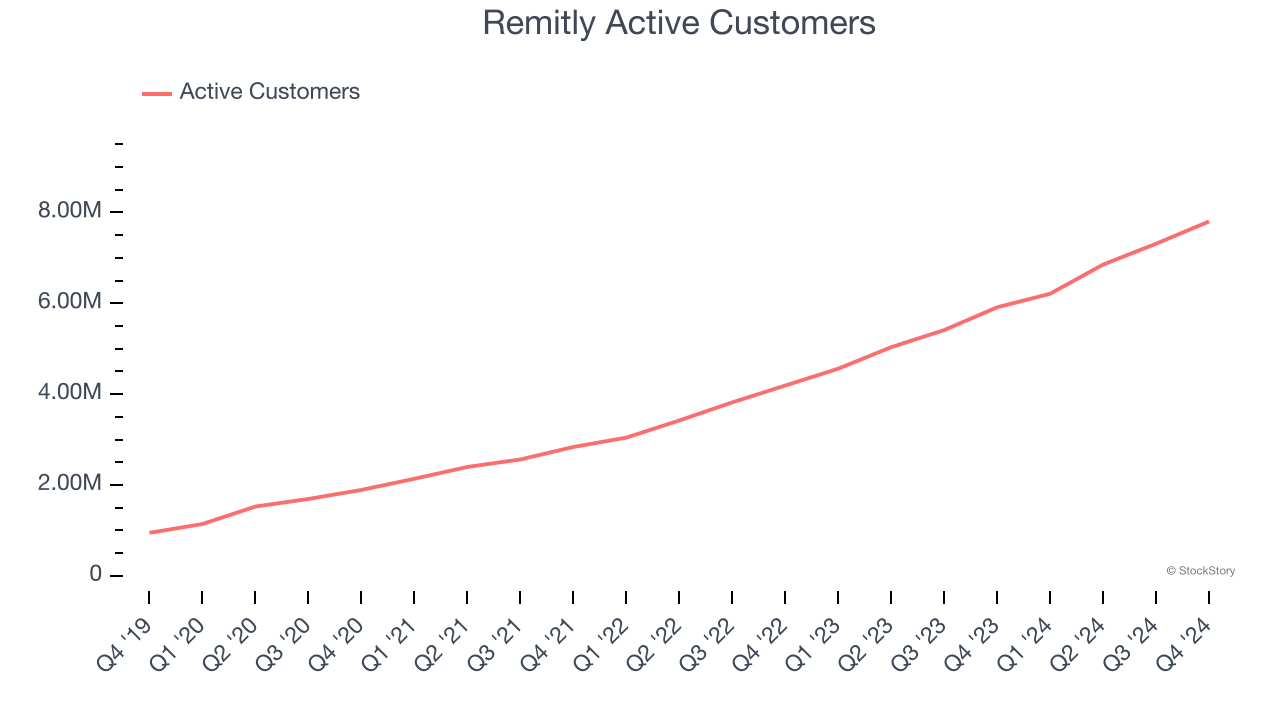

Active Customers

Customer Growth

As a fintech company, Remitly generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 39.9% annually to 7.8 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, Remitly added 1.89 million active customers, leading to 32% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating customer growth just yet.

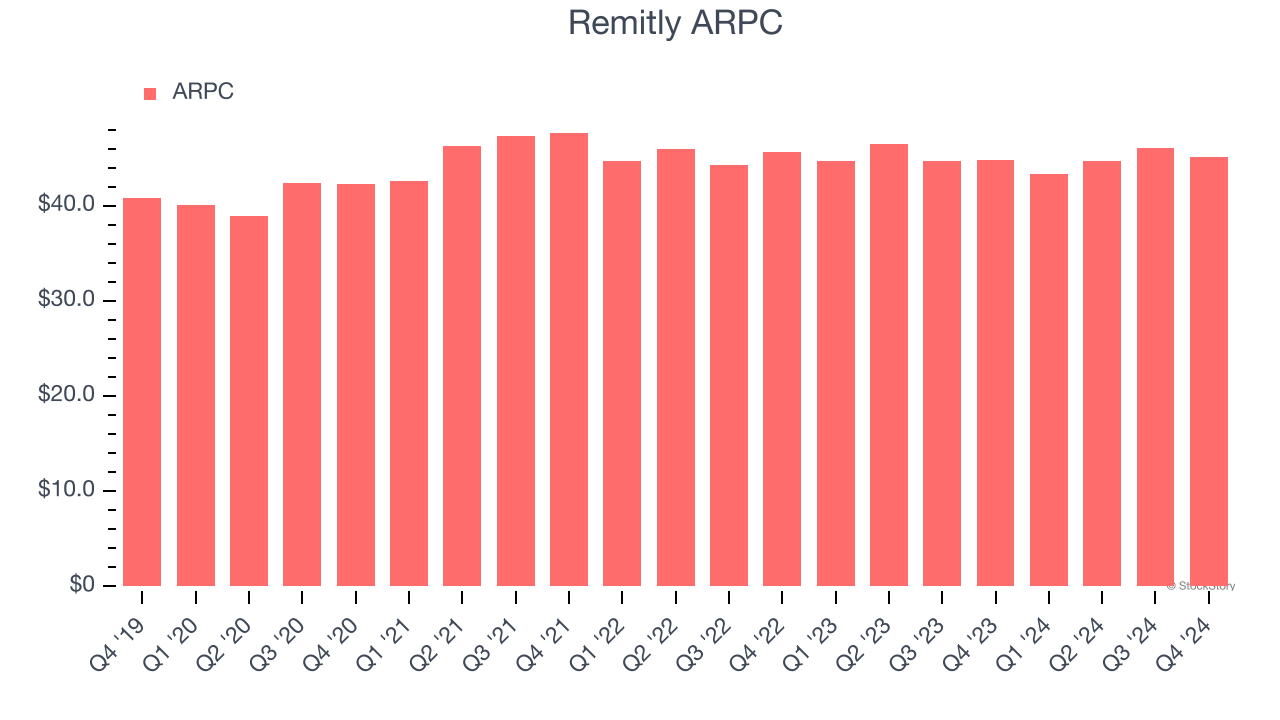

Revenue Per Customer

Average revenue per customer (ARPC) is a critical metric to track for fintech businesses like Remitly because it measures how much the company earns in fees from each user. ARPC also gives us unique insights into the average transaction size on its platform and Remitly’s take rate, or "cut", on each transaction.

Remitly’s ARPC has been roughly flat over the last two years. This isn’t great, but the increase in active customers is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Remitly tries boosting ARPC by taking a more aggressive approach to monetization, it’s unclear whether customers can continue growing at the current pace.

This quarter, Remitly’s ARPC clocked in at $45.11. It was flat year on year, worse than the change in its active customers.

Key Takeaways from Remitly’s Q4 Results

We were impressed by how significantly Remitly blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its full-year revenue and EBITDA guidance were much higher than Wall Street’s estimates. A slight negative was that its number of active customers missed. Still, we think this was a solid quarter with some key metrics above expectations. The stock traded up 7.7% to $27.90 immediately after reporting.

Remitly had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.