As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at vertical software stocks, starting with Guidewire (NYSE:GWRE).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.3% since the latest earnings results.

Best Q4: Guidewire (NYSE:GWRE)

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE:GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

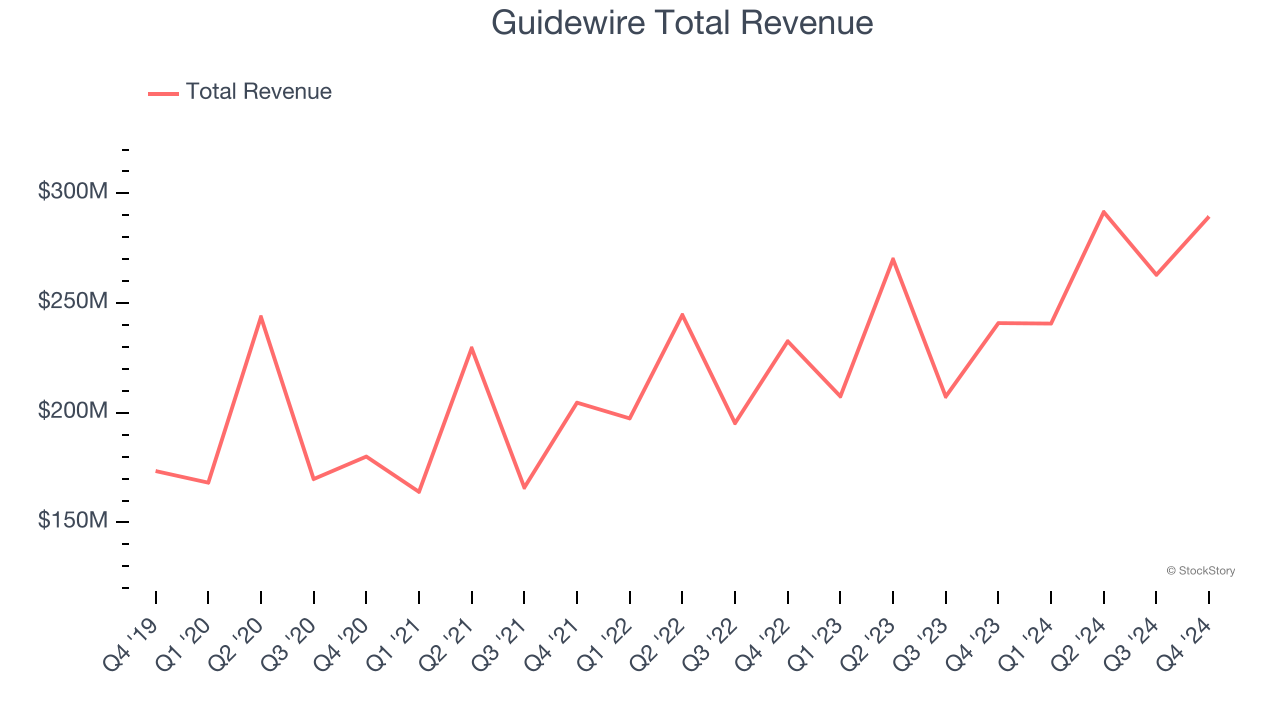

Guidewire reported revenues of $289.5 million, up 20.2% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Guidewire pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 8.6% since reporting and currently trades at $170.74.

Is now the time to buy Guidewire? Access our full analysis of the earnings results here, it’s free.

Alarm.com (NASDAQ:ALRM)

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ:ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

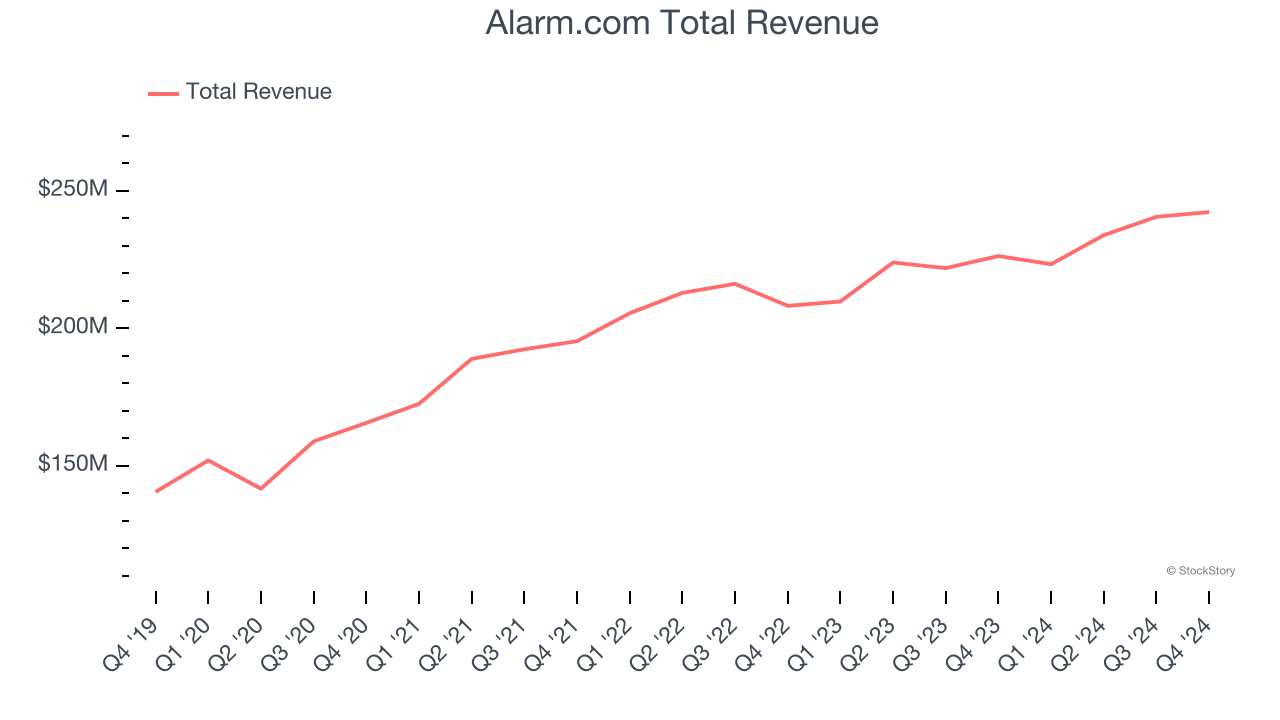

Alarm.com reported revenues of $242.2 million, up 7.1% year on year, outperforming analysts’ expectations by 1.4%. The business performed better than its peers, but it was unfortunately a mixed quarter with a decent beat of analysts’ billings estimates but full-year guidance of slowing revenue growth.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 4.3% since reporting. It currently trades at $58.

Is now the time to buy Alarm.com? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Bentley (NASDAQ:BSY)

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Bentley reported revenues of $349.8 million, up 12.6% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and a significant miss of analysts’ EBITDA estimates.

Bentley delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.8% since the results and currently trades at $43.02.

Read our full analysis of Bentley’s results here.

Manhattan Associates (NASDAQ:MANH)

Boasting major consumer staples and pharmaceutical companies as clients, Manhattan Associates (NASDAQ:MANH) offers a software-as-service platform that helps customers manage their supply chains.

Manhattan Associates reported revenues of $255.8 million, up 7.4% year on year. This print surpassed analysts’ expectations by 0.9%. Zooming out, it was a slower quarter as it logged full-year guidance of slowing revenue growth.

Manhattan Associates had the weakest full-year guidance update among its peers. The stock is down 42.4% since reporting and currently trades at $170.

Read our full, actionable report on Manhattan Associates here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.