Honeywell has been treading water for the past six months, recording a small return of 4.9% while holding steady at $211.08.

Is there a buying opportunity in Honeywell, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We don't have much confidence in Honeywell. Here are three reasons why we avoid HON and a stock we'd rather own.

Why Is Honeywell Not Exciting?

Originally founded in 1906 as a thermostat company, Honeywell (NASDAQ:HON) is a multinational conglomerate known for its aerospace systems, building technologies, performance materials, and safety and productivity solutions.

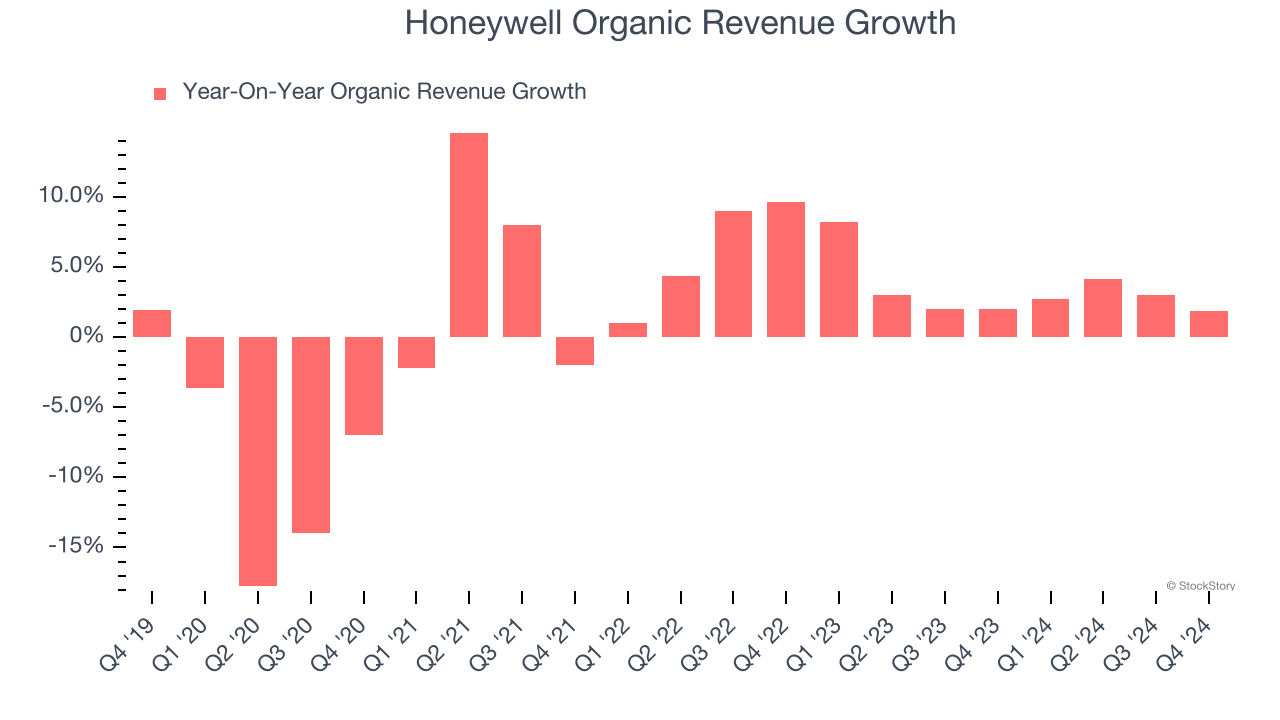

1. Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand General Industrial Machinery companies by analyzing their organic revenue. This metric gives visibility into Honeywell’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Honeywell’s organic revenue averaged 3.4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

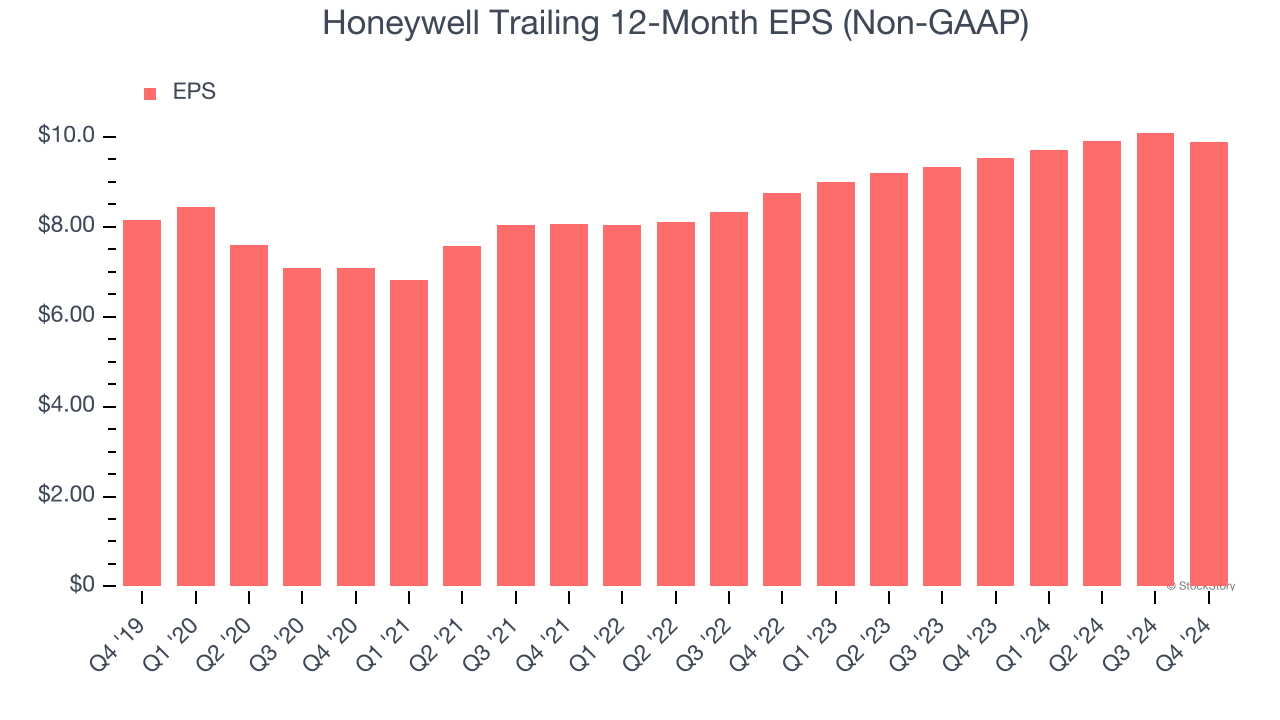

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Honeywell’s EPS grew at a weak 3.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

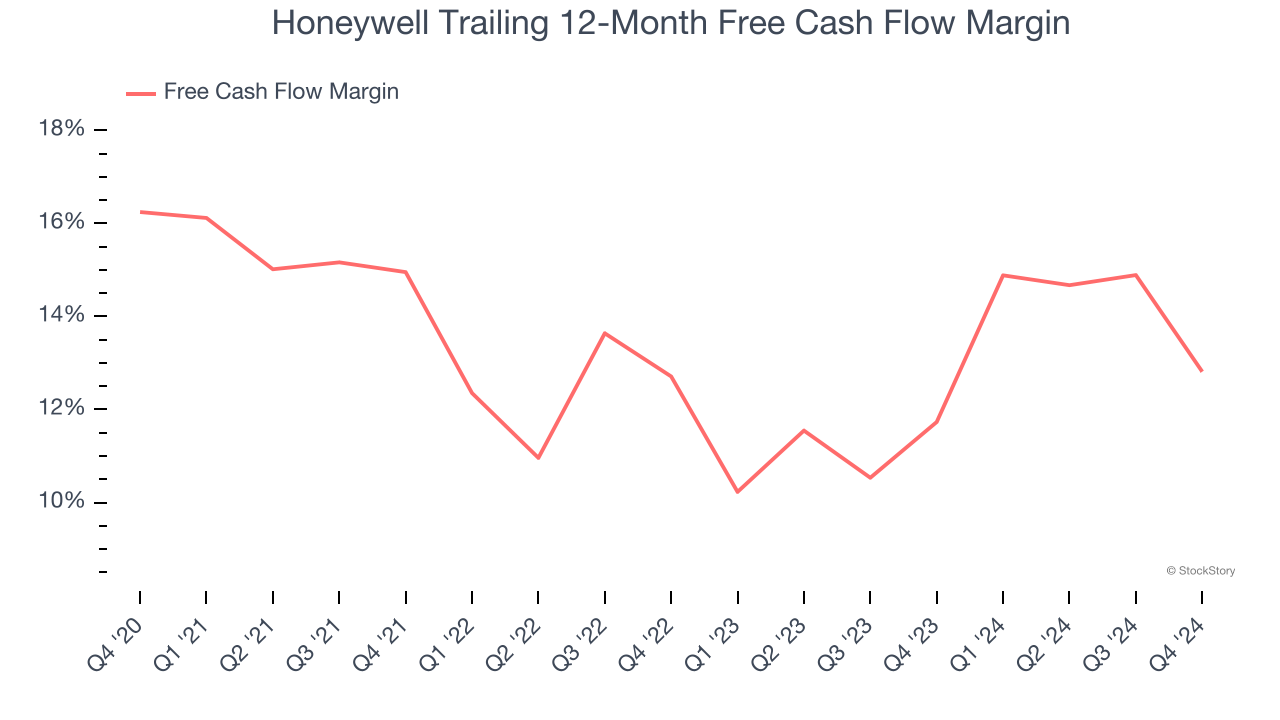

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Honeywell’s margin dropped by 3.4 percentage points over the last five years. If its declines continue, it could signal higher capital intensity and investment needs. Honeywell’s free cash flow margin for the trailing 12 months was 12.8%.

Final Judgment

Honeywell’s business quality ultimately falls short of our standards. That said, the stock currently trades at 19.4× forward price-to-earnings (or $211.08 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Honeywell

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.