The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how perishable food stocks fared in Q1, starting with Mission Produce (NASDAQ:AVO).

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

The 11 perishable food stocks we track reported a slower Q1. As a group, revenues beat analysts’ consensus estimates by 3.4%.

In light of this news, share prices of the companies have held steady as they are up 2.8% on average since the latest earnings results.

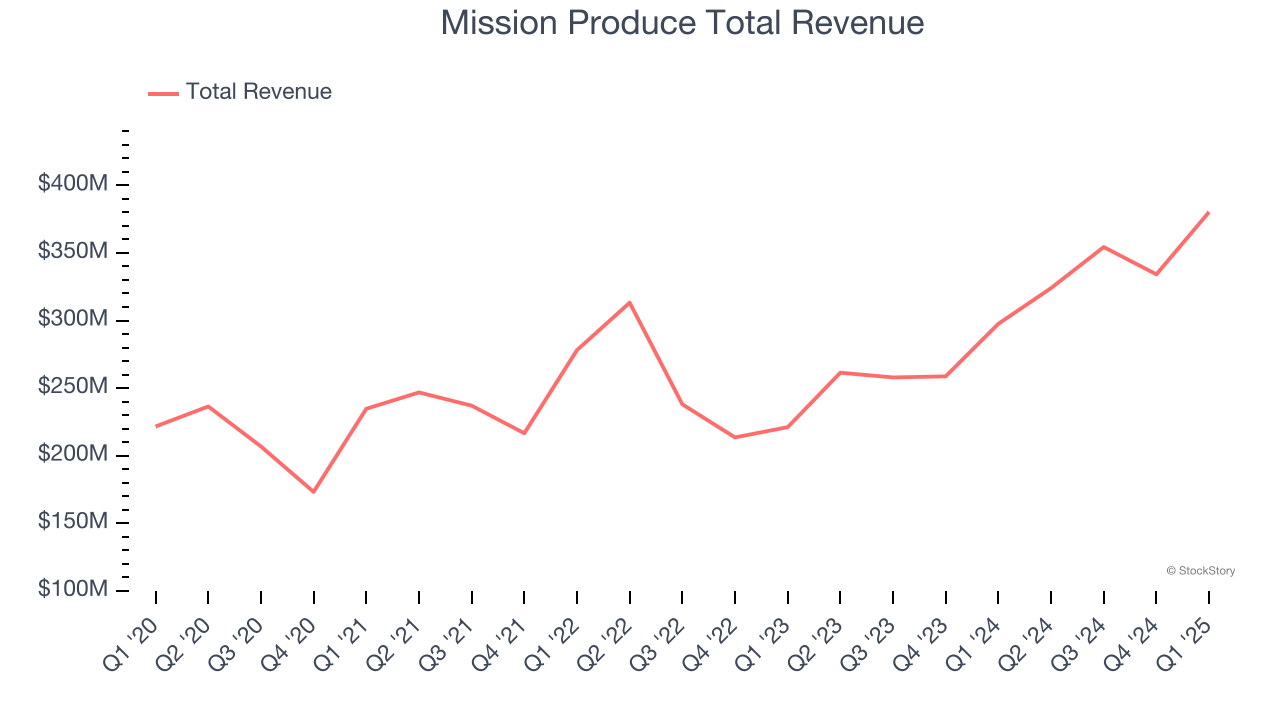

Best Q1: Mission Produce (NASDAQ:AVO)

Founded in 1983 in California, Mission Produce (NASDAQ:AVO) grows, packages, and distributes avocados.

Mission Produce reported revenues of $380.3 million, up 27.8% year on year. This print exceeded analysts’ expectations by 28.4%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Steve Barnard, CEO of Mission, stated, "We delivered record second quarter revenue and stronger than expected adjusted EBITDA performance. Our commercial teams successfully navigated typical seasonal supply challenges by leveraging our industry-leading global source network to satisfy customer commitments. While market pricing remained elevated during the second quarter and surpassed our expectation, distributed volumes were flat with the prior year period which speaks to the durability of consumption and the growing consistency of the category at retail. We are also pleased with the progression of key strategic priorities to enhance our position with customers, both in terms of products and global markets. Our mango business gained significant market share and achieved record volumes, establishing Mission as a leading U.S. distributor, while our operations in the United Kingdom are steadily gaining momentum through enhanced customer penetration which has optimized facility utilization following the strategic investment in the region. Looking ahead to the second half of the year, we are well-positioned to generate solid cash flow as we typically do through leveraging our own increased Peruvian supply to meet strong market demand."

Mission Produce scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 15.4% since reporting and currently trades at $12.16.

Is now the time to buy Mission Produce? Access our full analysis of the earnings results here, it’s free.

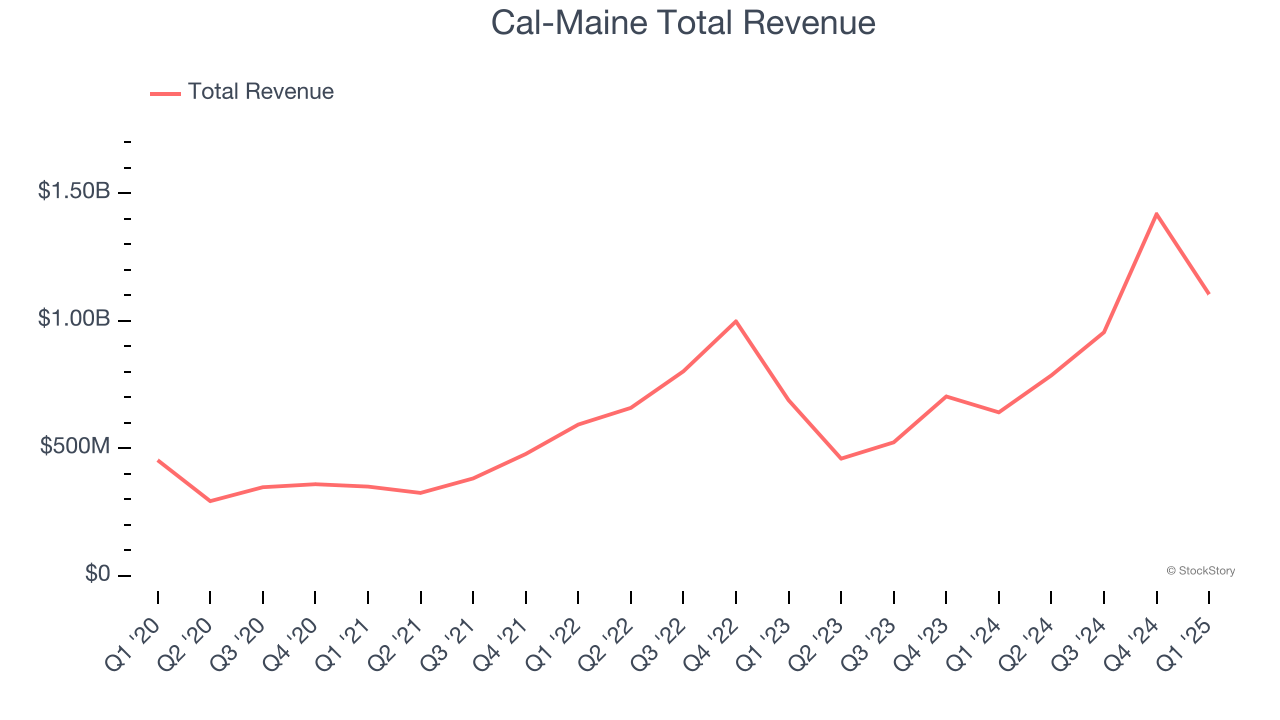

Cal-Maine (NASDAQ:CALM)

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Cal-Maine reported revenues of $1.10 billion, up 72.2% year on year, outperforming analysts’ expectations by 21.3%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ adjusted operating income estimates.

Cal-Maine scored the fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.5% since reporting. It currently trades at $106.50.

Is now the time to buy Cal-Maine? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Beyond Meat (NASDAQ:BYND)

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ:BYND) is a food company specializing in alternatives to traditional meat products.

Beyond Meat reported revenues of $68.73 million, down 9.1% year on year, falling short of analysts’ expectations by 8.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

Beyond Meat delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 53.2% since the results and currently trades at $3.91.

Read our full analysis of Beyond Meat’s results here.

Vital Farms (NASDAQ:VITL)

With an emphasis on ethically produced products, Vital Farms (NASDAQ:VITL) specializes in pasture-raised eggs and butter.

Vital Farms reported revenues of $162.2 million, up 9.6% year on year. This print met analysts’ expectations. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Vital Farms delivered the highest full-year guidance raise among its peers. The stock is up 1.4% since reporting and currently trades at $36.50.

Read our full, actionable report on Vital Farms here, it’s free.

Freshpet (NASDAQ:FRPT)

Standing out from typical processed pet foods, Freshpet (NASDAQ:FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

Freshpet reported revenues of $263.2 million, up 17.6% year on year. This number topped analysts’ expectations by 1.4%. More broadly, it was a mixed quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but full-year revenue guidance missing analysts’ expectations significantly.

Freshpet had the weakest full-year guidance update among its peers. The stock is down 5.1% since reporting and currently trades at $72.48.

Read our full, actionable report on Freshpet here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.