Smart home company SmartRent (NYSE:SMRT) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 21% year on year to $38.31 million. Its GAAP loss of $0.06 per share was in line with analysts’ consensus estimates.

Is now the time to buy SmartRent? Find out by accessing our full research report, it’s free.

SmartRent (SMRT) Q2 CY2025 Highlights:

- Revenue: $38.31 million vs analyst estimates of $38.86 million (21% year-on-year decline, 1.4% miss)

- EPS (GAAP): -$0.06 vs analyst estimates of -$0.06 (in line)

- Adjusted EBITDA: -$7.35 million vs analyst estimates of -$6.16 million (-19.2% margin, 19.3% miss)

- Operating Margin: -30.5%, down from -14.3% in the same quarter last year

- Free Cash Flow was -$18.6 million compared to -$14.12 million in the same quarter last year

- Annual Recurring Revenue: $56.9 million at quarter end, up 11.1% year on year

- Market Capitalization: $185.5 million

"SmartRent's opportunities for profitable growth and sustained market leadership are compelling. We operate in a large, expanding market with a purpose-built, differentiated platform and a growing SaaS footprint. As a hardware-enabled SaaS company with meaningful scale advantages, our foundation is built on domain expertise and close alignment with the needs of our customers - property owners and operators," commented Frank Martell, President and CEO of SmartRent.

Company Overview

Founded by an employee at a real estate rental company, SmartRent (NYSE:SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

Revenue Growth

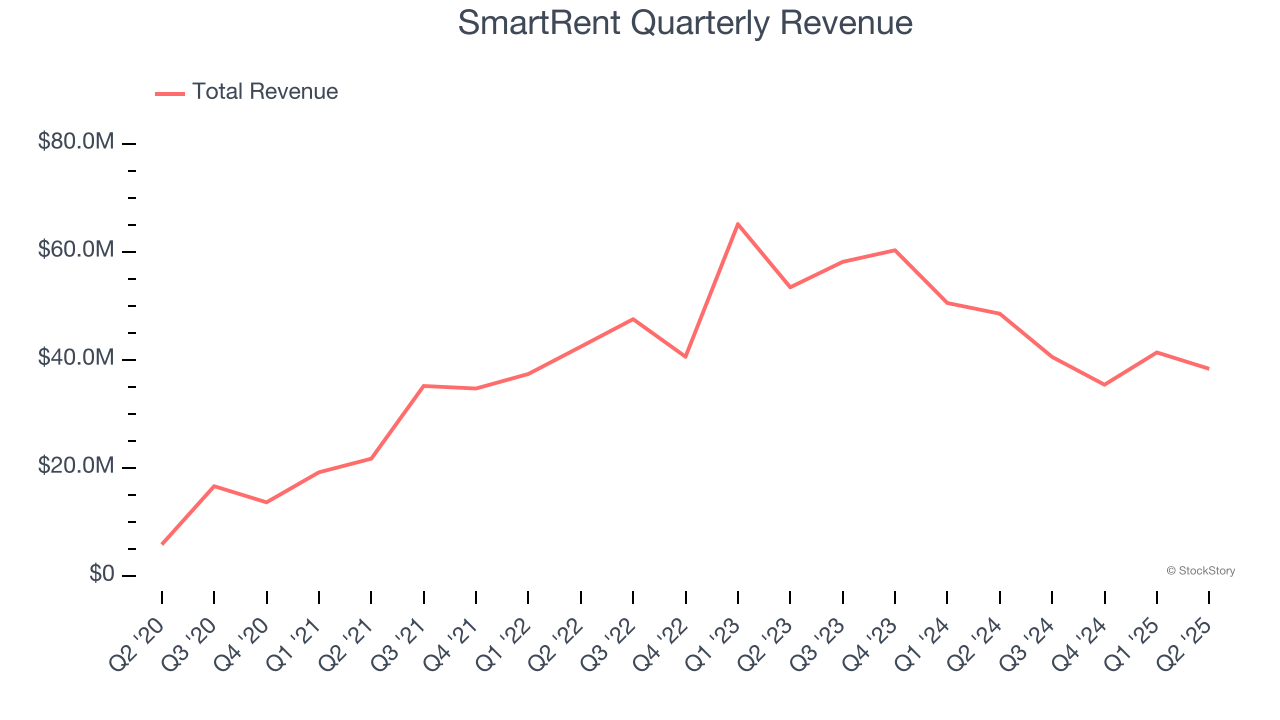

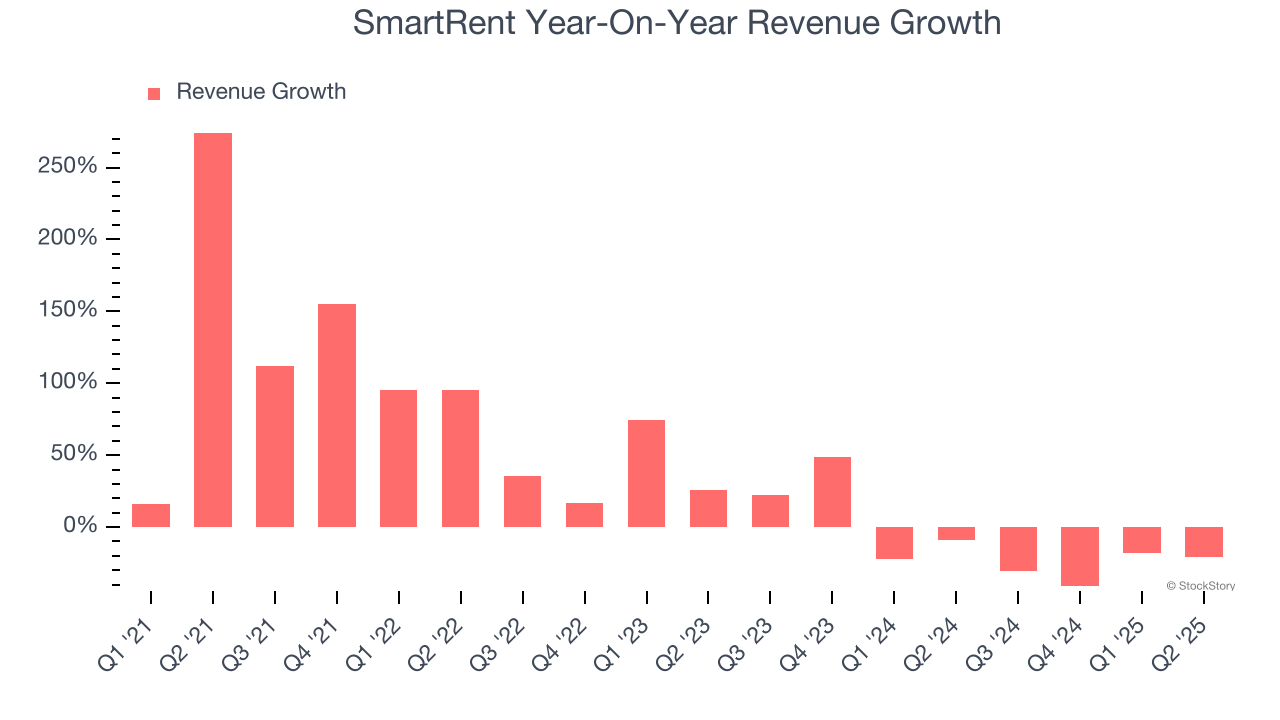

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, SmartRent’s 28.9% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SmartRent’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 13.2% over the last two years. SmartRent isn’t alone in its struggles as the Internet of Things industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

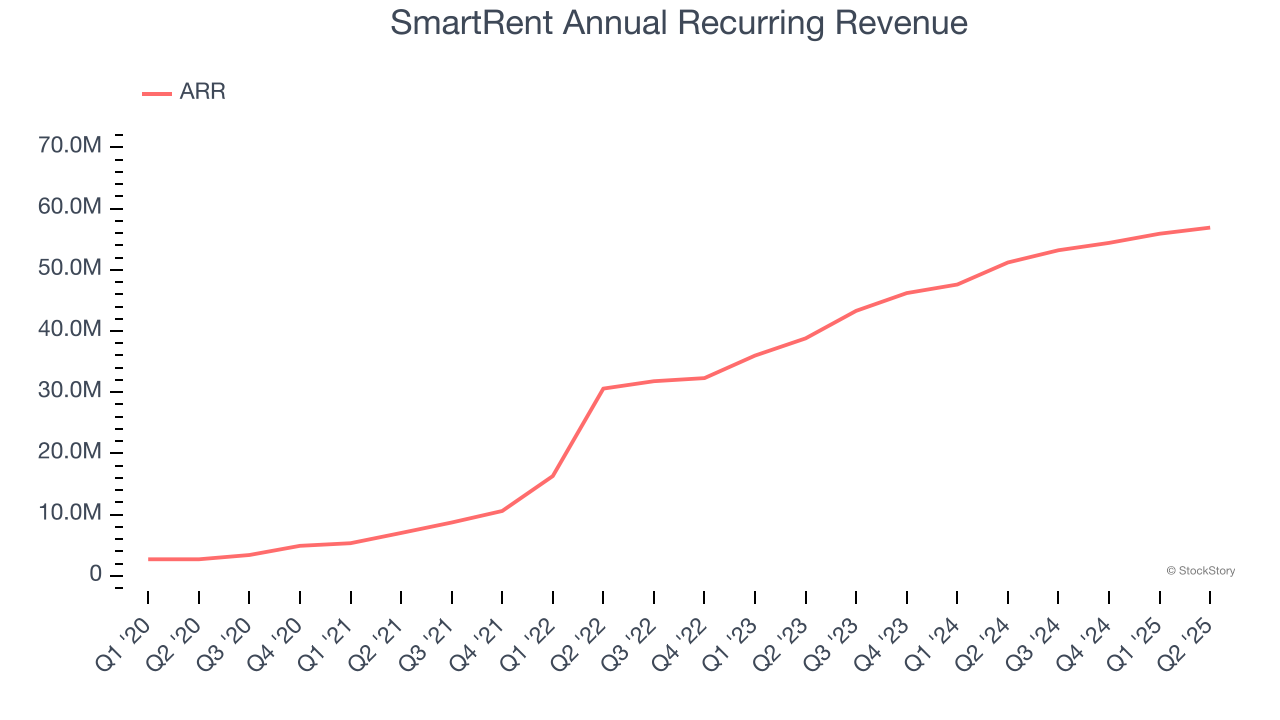

SmartRent also reports its annual recurring revenue (ARR), or the revenue it expects to generate from its existing customer base in the next 12 months. SmartRent’s ARR reached $56.9 million in the latest quarter and averaged 26.6% year-on-year growth over the last two years. Because this number is better than its normal revenue growth, we can see the company generated more revenue from its existing customers than new customers. Holding everything else constant, this is a positive sign as it should lead to lower sales and marketing expenses.

This quarter, SmartRent missed Wall Street’s estimates and reported a rather uninspiring 21% year-on-year revenue decline, generating $38.31 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

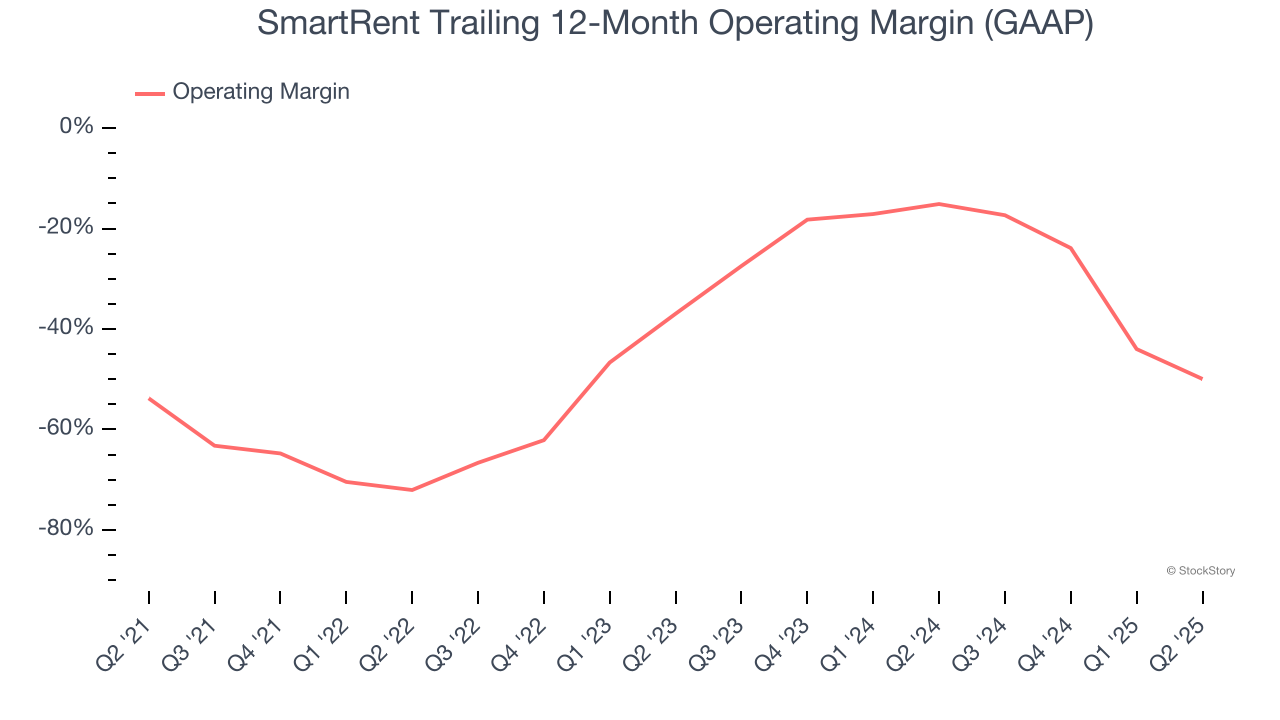

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

SmartRent’s high expenses have contributed to an average operating margin of negative 41.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, SmartRent’s operating margin rose by 3.8 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q2, SmartRent generated a negative 30.5% operating margin.

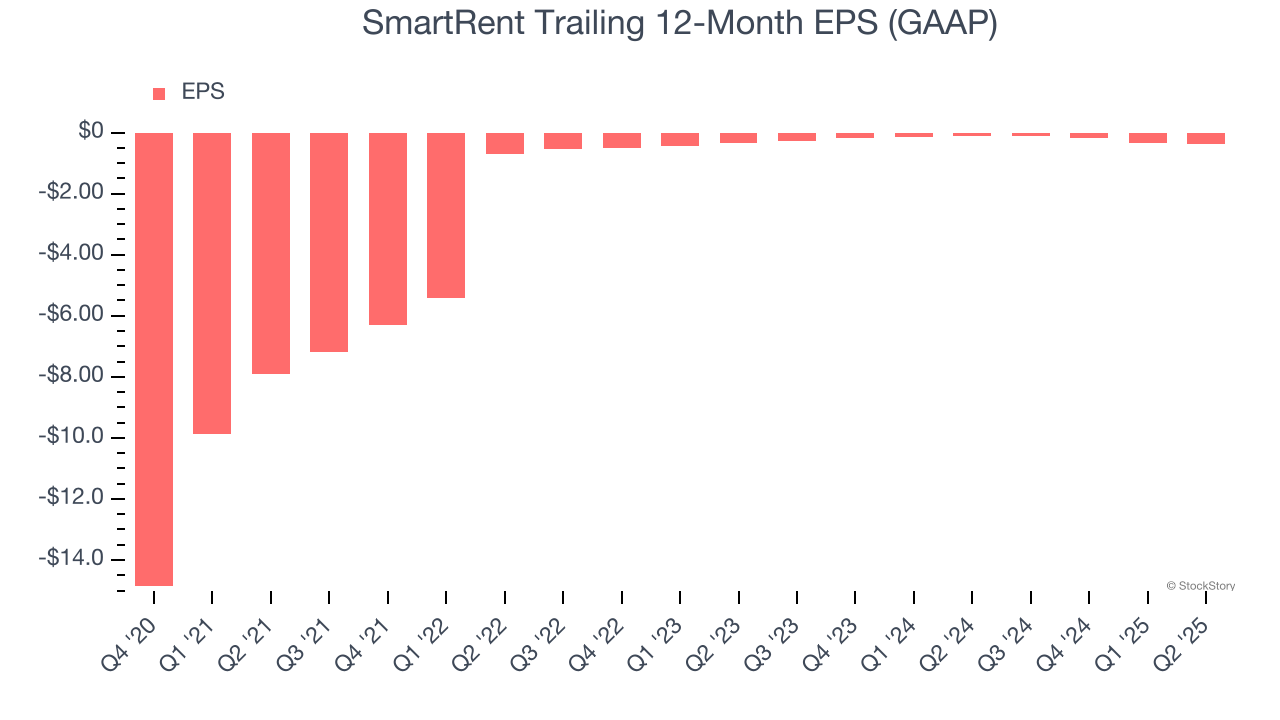

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although SmartRent’s full-year earnings are still negative, it reduced its losses and improved its EPS by 53.8% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For SmartRent, its two-year annual EPS declines of 2.6% mark a reversal from its (seemingly) healthy five-year trend. We hope SmartRent can return to earnings growth in the future.

In Q2, SmartRent reported EPS at negative $0.06, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from SmartRent’s Q2 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 6.4% to $0.92 immediately after reporting.

SmartRent didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.