Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at McKesson (NYSE:MCK) and the best and worst performers in the healthcare providers & services industry.

The healthcare providers and services sector, from insurers to hospitals, benefits from consistent demand, generating stable revenue through premiums and patient services. However, it faces challenges from high operational and labor costs, reimbursement pressures that squeeze margins, and regulatory uncertainty. Looking ahead, an aging population with more chronic diseases and a shift toward value-based care create tailwinds. Digitization via telehealth, data analytics, and personalized medicine offers new revenue streams. Nonetheless, headwinds persist, including clinical labor shortages, ongoing reimbursement cuts, and regulatory scrutiny over pricing and quality.

The 40 healthcare providers & services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 9.3% on average since the latest earnings results.

McKesson (NYSE:MCK)

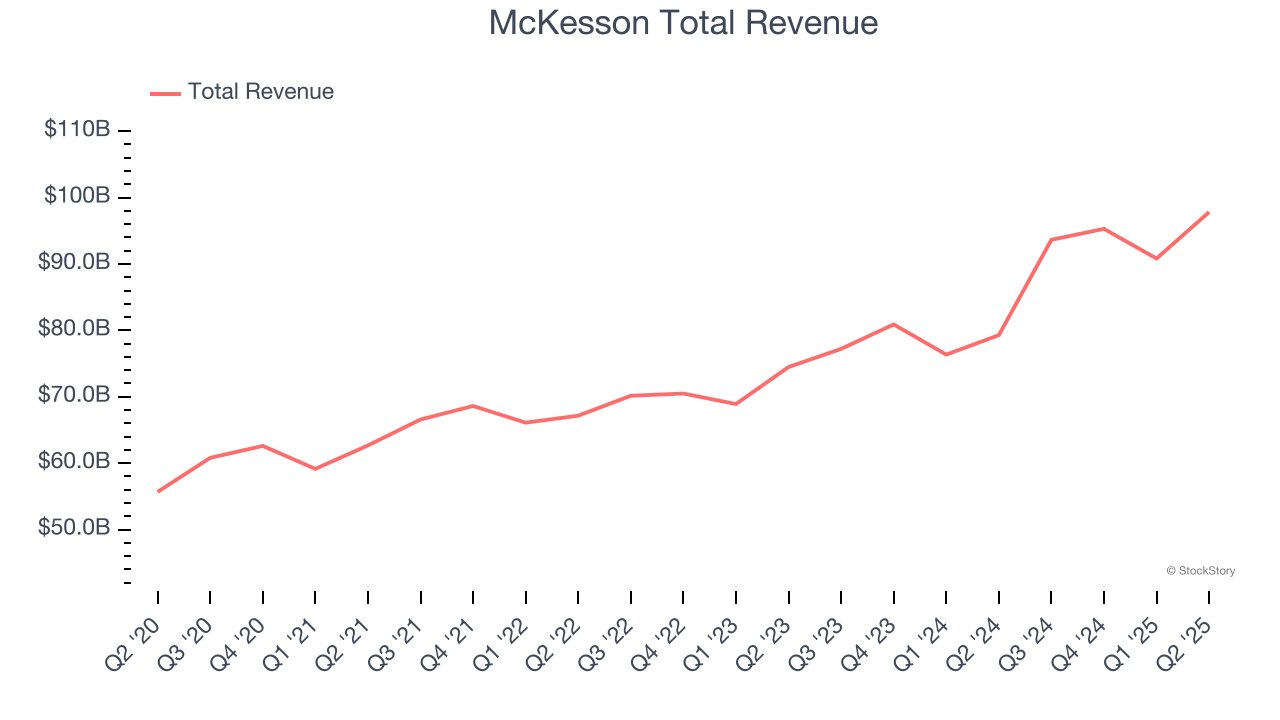

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE:MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

McKesson reported revenues of $97.83 billion, up 23.4% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ EPS estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $706.25.

Is now the time to buy McKesson? Access our full analysis of the earnings results here, it’s free.

Best Q2: CVS Health (NYSE:CVS)

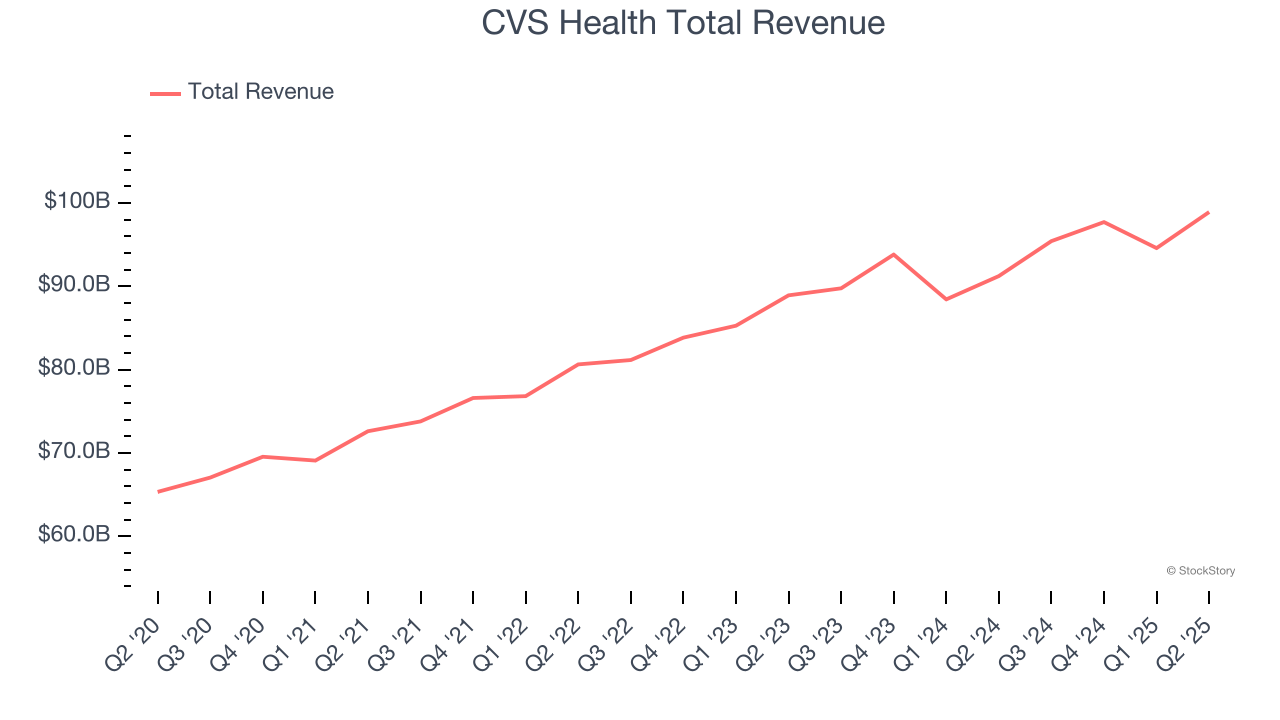

With over 9,000 retail pharmacy locations serving as neighborhood health destinations across America, CVS Health (NYSE:CVS) operates retail pharmacies, provides pharmacy benefit management services, and offers health insurance through its Aetna subsidiary.

CVS Health reported revenues of $98.92 billion, up 8.4% year on year, outperforming analysts’ expectations by 5.1%. The business had a stunning quarter with a solid beat of analysts’ same-store sales and EPS estimates.

The market seems happy with the results as the stock is up 18.5% since reporting. It currently trades at $73.87.

Is now the time to buy CVS Health? Access our full analysis of the earnings results here, it’s free.

Oscar Health (NYSE:OSCR)

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE:OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Oscar Health reported revenues of $2.86 billion, up 29% year on year, falling short of analysts’ expectations by 3.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 40.3% since the results and currently trades at $19.39.

Read our full analysis of Oscar Health’s results here.

Progyny (NASDAQ:PGNY)

Pioneering a data-driven approach to family building that has achieved an industry-leading patient satisfaction score of +80, Progyny (NASDAQ:PGNY) provides comprehensive fertility and family building benefits solutions to employers, helping employees access quality fertility treatments and support services.

Progyny reported revenues of $332.9 million, up 9.5% year on year. This print beat analysts’ expectations by 3.9%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ sales volume estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

The stock is down 1.7% since reporting and currently trades at $22.63.

Read our full, actionable report on Progyny here, it’s free.

Tenet Healthcare (NYSE:THC)

With a network spanning nine states and serving primarily urban and suburban communities, Tenet Healthcare (NYSE:THC) operates a nationwide network of hospitals, ambulatory surgery centers, and outpatient facilities providing acute care and specialty healthcare services.

Tenet Healthcare reported revenues of $5.27 billion, up 3.3% year on year. This number topped analysts’ expectations by 2.3%. Overall, it was a very strong quarter as it also produced a beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

The stock is up 9.7% since reporting and currently trades at $191.67.

Read our full, actionable report on Tenet Healthcare here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.