Wrapping up Q2 earnings, we look at the numbers and key takeaways for the cybersecurity stocks, including Tenable (NASDAQ:TENB) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 3.2% on average since the latest earnings results.

Weakest Q2: Tenable (NASDAQ:TENB)

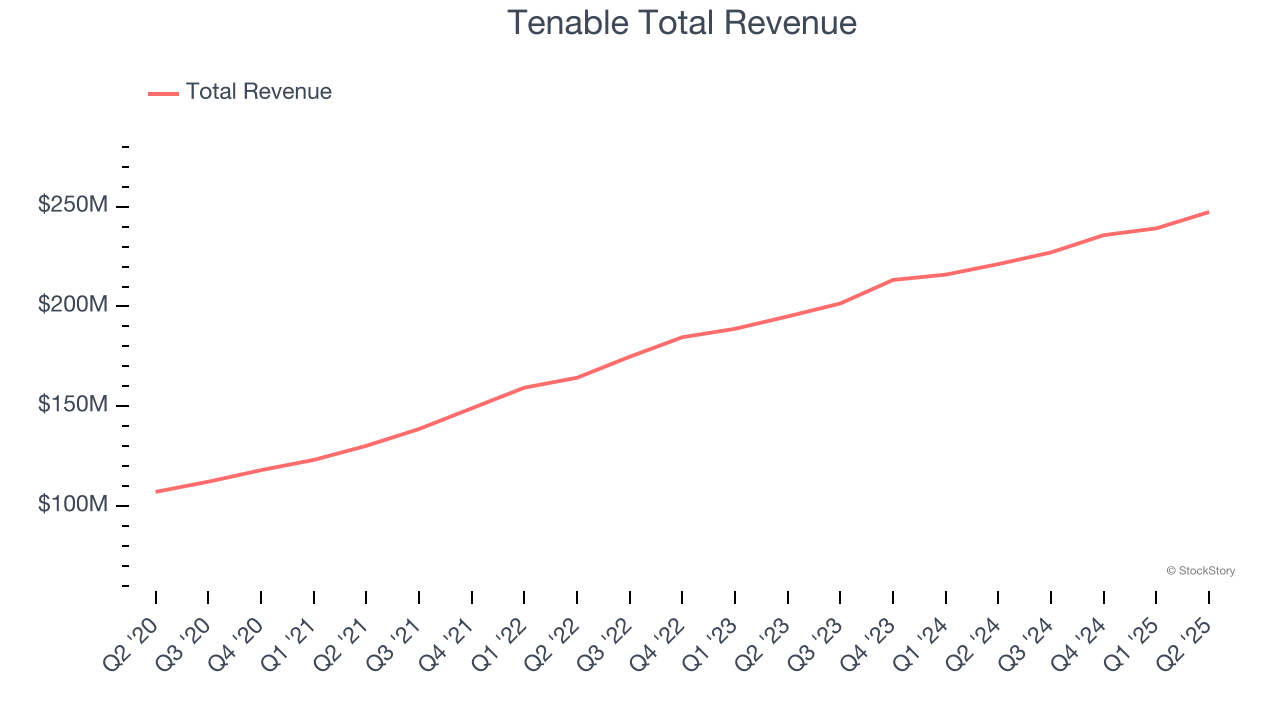

Starting with the widely-used Nessus vulnerability scanner first released in 1998, Tenable (NASDAQ:TENB) provides exposure management solutions that help organizations identify, assess, and prioritize cybersecurity vulnerabilities across their IT infrastructure and cloud environments.

Tenable reported revenues of $247.3 million, up 11.8% year on year. This print exceeded analysts’ expectations by 2.2%. Despite the top-line beat, it was still a slower quarter for the company with EPS guidance for next quarter missing analysts’ expectations.

"We beat all of our guided metrics during the quarter, delivering 12% revenue growth and 19% operating margin," said Steve Vintz, Co-CEO of Tenable.

Unsurprisingly, the stock is down 5.3% since reporting and currently trades at $30.54.

Read our full report on Tenable here, it’s free.

Best Q2: Varonis Systems (NASDAQ:VRNS)

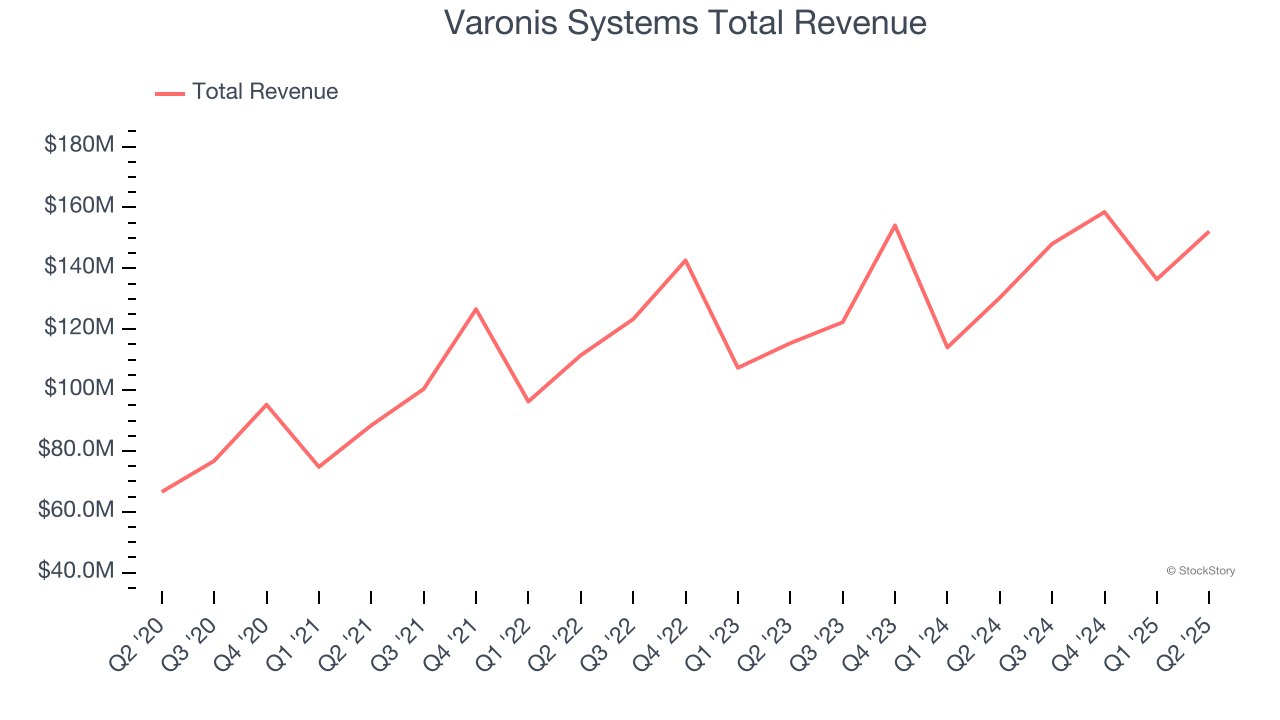

Beginning with protecting Windows file shares in 2005 and evolving into a comprehensive security platform, Varonis Systems (NASDAQ:VRNS) provides data security software that helps organizations protect sensitive information, detect threats, and comply with privacy regulations.

Varonis Systems reported revenues of $152.2 million, up 16.7% year on year, outperforming analysts’ expectations by 2.8%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Varonis Systems delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 5.4% since reporting. It currently trades at $57.19.

Is now the time to buy Varonis Systems? Access our full analysis of the earnings results here, it’s free.

SentinelOne (NYSE:S)

Built on the principle of "fighting machine with machine," SentinelOne (NYSE:S) provides an AI-powered cybersecurity platform that autonomously prevents, detects, and responds to threats across endpoints, cloud workloads, and identity systems.

SentinelOne reported revenues of $242.2 million, up 21.7% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

SentinelOne delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. The company added 54 enterprise customers paying more than $100,000 annually to reach a total of 1,513. Interestingly, the stock is up 4.4% since the results and currently trades at $18.41.

Read our full analysis of SentinelOne’s results here.

Zscaler (NASDAQ:ZS)

Pioneering the "zero trust" approach that has fundamentally changed enterprise network security, Zscaler (NASDAQ:ZS) provides a cloud-based security platform that connects users, devices, and applications securely without traditional network-based security hardware.

Zscaler reported revenues of $719.2 million, up 21.3% year on year. This number topped analysts’ expectations by 1.6%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ billings estimates and full-year guidance of robust revenue growth.

Zscaler achieved the highest full-year guidance raise among its peers. The stock is up 4.2% since reporting and currently trades at $286.01.

Read our full, actionable report on Zscaler here, it’s free.

Okta (NASDAQ:OKTA)

Named after the meteorological measurement for cloud cover, Okta (NASDAQ:OKTA) provides cloud-based identity management solutions that help organizations securely connect their employees, partners, and customers to the right applications and services.

Okta reported revenues of $728 million, up 12.7% year on year. This print beat analysts’ expectations by 2.3%. It was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance beating analysts’ expectations.

The stock is flat since reporting and currently trades at $92.08.

Read our full, actionable report on Okta here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.