Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Perella Weinberg (NASDAQ:PWP) and the best and worst performers in the investment banking & brokerage industry.

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

The 14 investment banking & brokerage stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 7.7%.

Thankfully, share prices of the companies have been resilient as they are up 6.4% on average since the latest earnings results.

Perella Weinberg (NASDAQ:PWP)

Founded in 2006 by veteran investment bankers Joseph Perella and Peter Weinberg during a wave of boutique advisory firm launches, Perella Weinberg Partners (NASDAQ:PWP) is a global independent advisory firm that provides strategic and financial advice to corporations, financial sponsors, and government institutions.

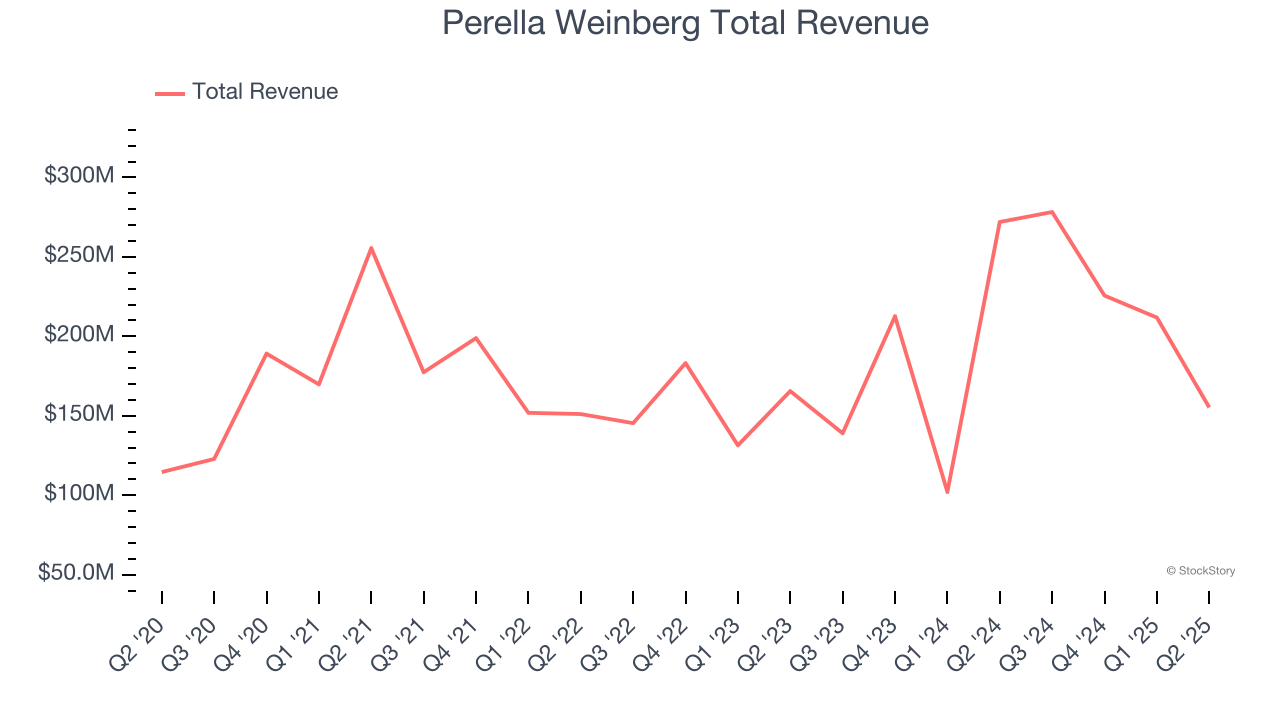

Perella Weinberg reported revenues of $155.3 million, down 42.9% year on year. This print exceeded analysts’ expectations by 12.9%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS estimates.

“Our first half results were in-line with our prior year performance and we entered the third quarter with robust client activity in a materially improved market environment compared to the start of the second quarter. We accelerated our investments in talent to expand our client coverage and broaden our capabilities — including the Devon Park transaction announced this morning — a strategic investment that significantly expands the services we provide to alternative asset managers across private equity, credit, infrastructure, venture, and real estate,” stated Andrew Bednar, Chief Executive Officer.

Perella Weinberg delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 11.2% since reporting and currently trades at $22.16.

Is now the time to buy Perella Weinberg? Access our full analysis of the earnings results here, it’s free.

Piper Sandler (NYSE:PIPR)

Tracing its roots back to 1895 and rebranded from Piper Jaffray in 2020, Piper Sandler (NYSE:PIPR) is an investment bank that provides advisory services, capital raising, institutional brokerage, and research for corporations, governments, and institutional investors.

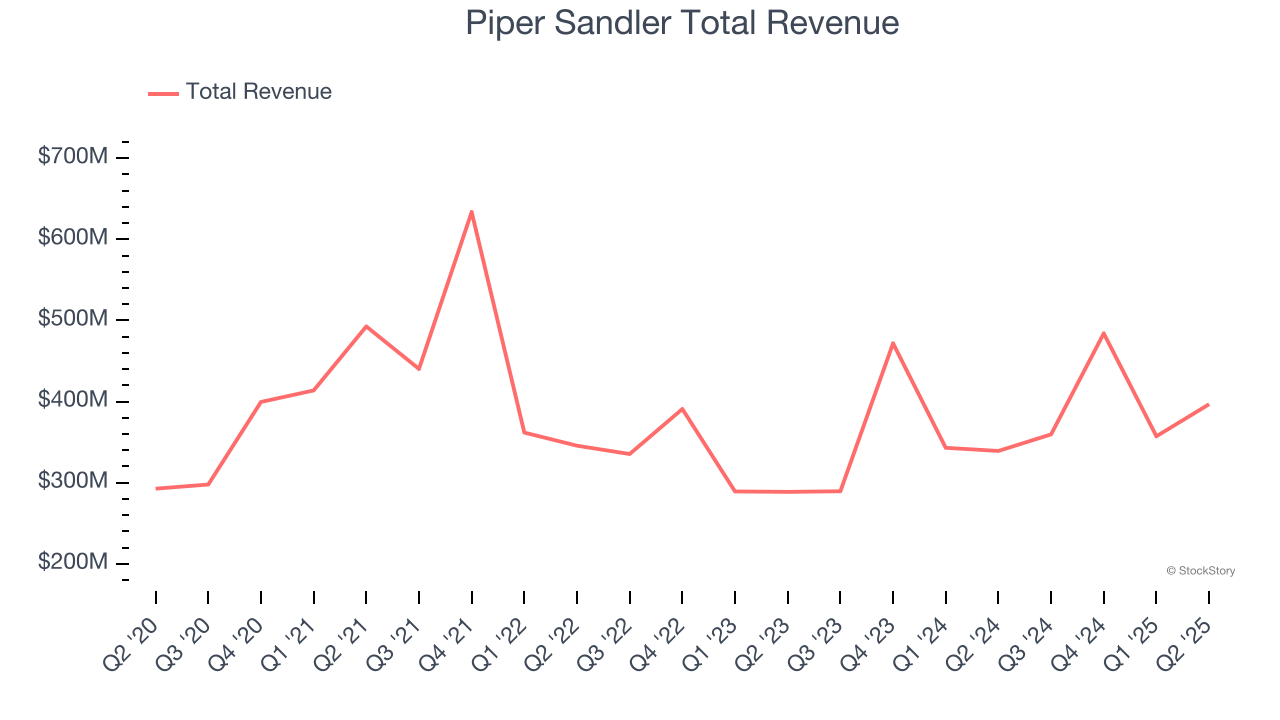

Piper Sandler reported revenues of $396.8 million, up 17% year on year, outperforming analysts’ expectations by 13.3%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 12.6% since reporting. It currently trades at $354.35.

Is now the time to buy Piper Sandler? Access our full analysis of the earnings results here, it’s free.

Charles Schwab (NYSE:SCHW)

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE:SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

Charles Schwab reported revenues of $5.85 billion, up 24.8% year on year, exceeding analysts’ expectations by 2%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ EBITDA and EPS estimates.

The stock is flat since the results and currently trades at $92.30.

Read our full analysis of Charles Schwab’s results here.

Lazard (NYSE:LAZ)

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE:LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

Lazard reported revenues of $769.9 million, up 12.4% year on year. This result surpassed analysts’ expectations by 9.5%. Overall, it was an incredible quarter as it also logged a beat of analysts’ EPS and AUM estimates.

The stock is up 1.2% since reporting and currently trades at $55.61.

Read our full, actionable report on Lazard here, it’s free.

Interactive Brokers (NASDAQ:IBKR)

Founded in 1977 and known for its sophisticated trading technology and global reach across 150+ exchanges in 34 countries, Interactive Brokers (NASDAQ:IBKR) is a global electronic broker that provides low-cost trading and investment services across stocks, options, futures, forex, bonds, and other financial instruments.

Interactive Brokers reported revenues of $1.48 billion, up 14.7% year on year. This print beat analysts’ expectations by 6.3%. It was an exceptional quarter as it also put up a beat of analysts’ EPS estimates and transaction volumes in line with analysts’ estimates.

The stock is up 5.1% since reporting and currently trades at $62.50.

Read our full, actionable report on Interactive Brokers here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.