| |||||||||

|  |  |  |  | |||||

Vancouver, BC – TheNewswire - September 11, 2025 – Global Stocks News – Sponsored content disseminated on behalf of NexMetals Mining. On September 3, 2025, NexMetals Mining (TSXV: NEXM) (NASDAQ: NEXM) announced a significant metallurgical break though at its past-producing copper-nickel-cobalt Selebi Mines in Botswana.

NexMetals owns two previously-producing Cu-Ni-Co mines in Botswana, a safe, mineral-rich Tier 1 mining jurisdiction in Africa.

The underground Selebi Mines were in production between 1980 and 2016. Both Selebi and Selebi North mines, having produced 40 million tonnes of ore, were put into Care & Maintenance due to low metal prices and a failure of the on-site smelter.

Smelters are not cheap to build, refurbish or operate. A planned copper smelter in Kazakhstan has a projected $1.5 billion price tag. The environmental permitting required for smelters can add years, if not decades, to the development process.

Following NexMetals’ bulk sample-based metallurgical program at its Selebi Mines in Botswana, the company has created “the optionality to produce both a saleable copper concentrate and a saleable nickel concentrate”.

September 3, 2025 metallurgical news highlights:

-

on-site smelter may not be required

-

significant reduction in capital expenditure

-

simplified permitting process

-

smaller environmental footprint

-

lower energy costs

-

expanded commercial pathways for mined products

-

more competitive environment for off-take agreements

-

reduction of operational complexity

-

Fewer highly specialised employees required

-

Faster, cheaper, more efficient re-start

"This is the largest transformational step forward for the Selebi Mines that could materially change this asset,” stated NexMetals CEO Morgan Lekstrom in the September 3, 2025 press release. “We now have the optionality to generate two separate saleable copper and nickel-cobalt concentrates, which may reduce or remove the need for capex to build a smelter/ hydrometallurgy plant.”

The underground bulk samples were taken from both the Selebi North and Selebi Main deposits, representing the projected operational profile with both shafts in production.

Excellent Initial Recoveries with the Objective to Increase Recoveries:

-

Copper concentrate - 87.0% Cu recovery

-

Nickel concentrate - 55.9% Ni recovery and 64.7% Co recovery

High-Grade Saleable Concentrates:

-

Copper concentrate - 27.6% Cu

-

Nickel concentrate - 10.5% Ni and 0.59% Co

NexGold’s President Sean Whiteford is a geologist and mining executive who has held corporate, operational and technical roles at BHP and Rio Tinto. He has technical and budgetary oversight on the Botswana operations, including exploration and engineering studies.

In the September 3, 2025 6-minute video below, Whiteford explains the metallurgy process, the results and the significance to the Selebi Mine redevelopment plan.

“We have existing underground infrastructure that allows us to access various parts of the resource and blast fresh new samples,” stated Whiteford in the video. “We blasted up to 95 tons from both Selebi Main and Selebi North. The results and the blending give us a statistically robust sampling. That means we have high confidence in our results.”

“A Lock Cycle Test or LCT test is a common process in metallurgical development work. It simulates continuous plant performance, mimicking a closed loop system from a large-scale operational processing plant”.

“Our copper concentrate is 27.6% grade, 87% recovery. We have a grade of 10.5% nickel, and we recovered 55.9% of the nickel in the concentrate. We are working on ways to increase our nickel recovery. We also have recovered a grade .59% cobalt in the nickel concentrate, and that represents 64.7% of the cobalt in the concentrate.”

“Producing separate saleable concentrates gives NexMetals a strategic advantage because now we have an alternative development option with lower capex, lower OPEX and lower execution risk.”

Recent interest in the Selebi and Selkirk Mines has been catalysed by a surge in demand for critical metals required for the green energy transformation (Solar, EVs). In the last five years, as demand drivers intensify, the price of copper has increased 92% - from USD $2.36/lb to $4.50/lb.

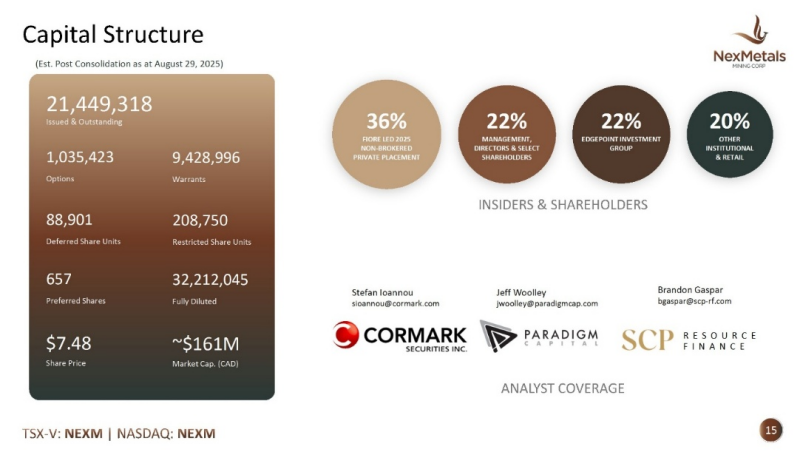

On March 18, 2025 it was announced that a consortium of institutional investors made sizable early bets on the future of NexMetals assets. The $46 million non-brokered equity financing included the participation of the Fiore Management and Advisory Corporation, headed by Frank Giustra.

“NexMetals has been reactivated with new money, new talent and new ideas,” Lekstrom told Guy Bennett, CEO of Global Stocks News (GSN).

For the last decade, diamonds have accounted for around 80% of Botswana’s exports, one-third of fiscal revenues, and one-quarter of GDP. Botswana is the world’s largest diamond producer by value. That revenue stream is shrinking.

“The market for natural diamonds is in crisis, with cut-price lab-grown equivalents hitting demand particularly hard in the U.S.,” reports Japan Times (JT) on September 4, 2025.

“Copper production provides the most immediate source of economic diversification,” notes Lyle Begbie, an economist at Oxford Economics Africa.

“Buoyed by soaring global demand for energy and electrification projects, Begbie says that copper mining is ‘starting to rise from the ashes again’ in Botswana,” reports African Business.

"We must now focus on job creation,” confirmed Botswana President Duma Boko, who is promoting investment in tourism, renewable energy, technology, agriculture and mining.

“I’ve had the privilege of meeting the new President Duma Boko,” Lekstrom told GSN. “He is a Harvard Law School graduate, a passionate politician and a sharp businessman.”

“President Boko wants to expand Botswana’s extraction industry beyond diamonds,” continued Lekstrom. “We believe the Selebi and Selkirk copper-nickel projects can play a positive role in Botswana’s next economic evolution.”

Results from the new metallurgical direction announced on September 3, 2025 together with ongoing resource expansion drilling, will be incorporated into an updated mineral resource estimate (MRE), which NEXM anticipates will demonstrate a significant improvement over the previous estimate.

The mineral resource estimate on the Selebi Mine is supported by the technical report entitled "Technical Report, Selebi Mines, Central District, Republic of Botswana" and dated September 20, 2024 (with an effective date of June 30, 2024) (the "Selebi Technical Report"), and prepared by SLR Consulting (Canada) Ltd. for NEXM. Reference should be made to the full text of the Selebi Technical Report, which was prepared in accordance with NI 43-101 and Subpart 1300 of Regulation S-K and is available on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov), in each case, under NEXM's issuer profile.

All scientific and technical information in this release has been reviewed and approved by Norman Lotter, P.Eng., Pr.Eng., C.Eng., FSAIMM, FIMM, Consulting Engineer, and by Sharon Taylor, Vice President Exploration of the Company, who are "qualified persons" for the purposes of NI 43-101 a "qualified person" for the purposes of National Instrument 43-101 and Subpart 1300 of Regulation S-K.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: NexMetals Mining paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” and “target,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Copyright (c) 2025 TheNewswire - All rights reserved.