Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

The CPI components suggest that inflation’s glide path through the “final mile” will remain sticky.

Via Talk Markets · February 14, 2026

The concern about the dollar losing its status as the reserve currency is silly. But there is a real issue with banks, pension funds, and other investors moving away from dollars.

Via Talk Markets · February 14, 2026

Wall Street loves a simple story and is happy to jump on a trend with momentum, selling products to unwitting consumers. A good example of that lately has been the “weak dollar” narrative, which has pushed investors to chase foreign assets.

Via Talk Markets · February 14, 2026

While the S&P has hit a new record high this year, it is having a difficult time rising back above 7,000. The technical action is weak, and the 20-Daily Moving Average is in danger of crossing below the 50-Daily Moving Average.

Via Talk Markets · February 14, 2026

The world is in the midst of a generational shift.

Via Talk Markets · February 14, 2026

U.S. investors are waking up to opportunities outside our borders, and that’s a good thing.

Via Talk Markets · February 14, 2026

Inflation worries are again on the back burner, and that made for quite some moves in cyclicals and interest rate sensitive names.

Via Talk Markets · February 14, 2026

The high level of new lows continues to be worrisome.

Via Talk Markets · February 14, 2026

Leverage, once a vital tool, has become an existential weapon

Via Talk Markets · February 14, 2026

Since Jan. 28, we’ve had a collapse in gold and silver prices, a blowout in the cryptocurrency world, and one of the worst momentum selloffs in over a decade. Selling pressure has increased. Let's take a closer look at some charts.

Via Talk Markets · February 14, 2026

Spring may be approaching (even if the cold weather outside says otherwise). 'Green shoots' are once again poking through in the global economy. But which ones will flourish, and which will turn to weeds?

Via Talk Markets · February 14, 2026

While markets sit near all-time highs, massive rotations have created wide dispersion -- especially in technology stocks. But history and evidence suggest that now could be a great time to buy beaten-down software stocks.

Via Talk Markets · February 14, 2026

It’s Valentine’s Day, which means there’s no better time to talk about the most loving thing you can do for your significant other and your family: make sure they’re taken care of when you’re gone. And I'm not talking about life insurance.

Via Talk Markets · February 14, 2026

Energy Transfer is expected to post a year-over-year improvement in both revenues and earnings when it reports fourth-quarter results on Feb. 17. The company's fee-based contracts, new gas supply deals, and added plants will likely support earnings.

Via Talk Markets · February 14, 2026

What happened in 2025? What’s in store this year?

Via Talk Markets · February 14, 2026

With risk aversion gathering momentum, deleveraging looms.

Via Talk Markets · February 14, 2026

Via Talk Markets · February 14, 2026

Perhaps the single most important macro phenomenon of the past several decades is the precipitous decline in the labor share of income.

Via Talk Markets · February 14, 2026

The wrong sectors led us higher while the right ones faded. Now the crowd is finally noticing the pattern. Today, I’ll take you through the specific signal I watch to identify when selling is about to exhaust itself.

Via Talk Markets · February 14, 2026

Nvidia received validation this week as 4 of the world’s largest technology companies announced massive increases to their artificial intelligence infrastructure budgets for 2026. The spending surge has far exceeded Wall Street’s initial projections.

Via Talk Markets · February 14, 2026

Financial firms continue to invest in digital assets, tokenization, and market infrastructure even while Bitcoin has fallen back toward levels last seen in 2024. That tells you serious money is still being committed to the space.

Via Talk Markets · February 14, 2026

Gold and silver have been chopping in a dangerous range, leaving investors wondering: Is the bottom in, or are we setting up for another massive flush?

Via Talk Markets · February 14, 2026

Getting a lump sum to invest sounds like a good problem—and it is—but it can also feel like an anxiety-inducing puzzle. The number one question remains: what do you buy, and when do you buy it?

Via Talk Markets · February 14, 2026

Despite Micron's impressive run, significant upside remains available in 2026 and beyond.

Via Talk Markets · February 14, 2026

This article argues that SOXL, the triple-bull semiconductor ETF, has hit a lofty price zone for the third time and, in the author’s view, is likely headed significantly lower in 2026

Via Talk Markets · February 13, 2026

Given all of the progress the company made in 2025, MannKind Corp. appears to be a top pick for 2026. Its lead product is Afrezza, an inhalable form of insulin for both Type 1 and Type 2 diabetics.

Via Talk Markets · February 14, 2026

Here is a short look at the 10 largest companies by market capitalization as of Saturday, Feb. 14, 2026. Additionally, I have included the percentages of their gains on a year-to-date basis. Let's dive into the numbers.

Via Talk Markets · February 14, 2026

If recent market action feels confusing, it should. Over the past several weeks, many of the market’s former leaders have been sharply repriced, in a trend that has been evolving for months. Is this just a dip or a major shift for the markets?

Via Talk Markets · February 14, 2026

You probably know about Blackstone, the world’s largest alternative asset manager. The company has a reputation as the “king of private equity.” And for good reason. The stock has also been a great one to own for years.

Via Talk Markets · February 14, 2026

The greenback fell against the G10 currencies last week but consolidation seemed to be the main feature.

Via Talk Markets · February 14, 2026

Yelp operates a leading digital marketplace connecting consumers with local businesses across restaurants, home services, retail, and professional services.

Via Talk Markets · February 14, 2026

After rocketing parabolic in a popular speculative mania, silver violently crashed. It suffered some of its biggest down days ever in recent weeks, shockingly-brutal plummeting

Via Talk Markets · February 13, 2026

Copper prices “have to go up” over the next decade, driven by rising demand and a supply gap that “cannot be bridged”.

Via Talk Markets · February 14, 2026

This week saw wholly expected volatile behavior in the last serious week of this bumpy earnings season.

Via Talk Markets · February 14, 2026

The golden age seems to be delayed.

Via Talk Markets · February 14, 2026

We have been inundated with employment and labor data over the past few weeks. Some of it is finally catching up from reports delayed due to the government shutdown.

Via Talk Markets · February 14, 2026

January delivered the kind of mix investors and policymakers have been looking for: inflation cooled even as the labor market kept adding jobs.

Via Talk Markets · February 14, 2026

Rivian stock is still down some 20% versus its 52-week high.

Via Talk Markets · February 14, 2026

While the absolute number for aggregate payrolls was revised downward, the upward trend remained intact.

Via Talk Markets · February 14, 2026

U.S. investors are shifting away from Bitcoin and Ethereum ETFs, moving funds into international equity markets amid rising Treasury yields.

Via Talk Markets · February 14, 2026

Fundamentally, the US remains structurally short aluminium, with domestic smelting capacity having declined over the past two decades due to high power costs and global competitive pressures.

Via Talk Markets · February 14, 2026

We can think of our efforts to understand the economy as being like putting together a jigsaw puzzle. Each data report gives us a piece, but none of them can tell the whole picture.

Via Talk Markets · February 14, 2026

Micron Technology’s stock surge looks set to continue as strong memory chip demand boosts pricing power and earnings, helping MU extend its rally amid favorable industry dynamics

Via Talk Markets · February 14, 2026

While much of the Technology sector has struggled in 2026, these three stocks have largely avoided the selloff, benefiting significantly, either directly or indirectly, from strong and sustained AI-driven demand.

Via Talk Markets · February 14, 2026

This article shows Cleveland Fed nowcasts of instantaneous PCE and core PCE inflation drifting away from the Fed’s 2% target in recent data, signaling inflation dynamics that may complicate policy expectations.

Via Talk Markets · February 14, 2026

In this week's video, we'll review the latest charts and data to help us answer the question, what does history tell us about the AI disruption narrative?

Via Talk Markets · February 14, 2026

This article explains how much 2026 Olympic medals are worth based on metal content, with gold medals made mainly of silver + gold plating and silver medals’ melt value boosted by rising precious-metal prices.

Via Talk Markets · February 14, 2026

Poland’s current account deficit for December widened more than forecasted by market consensus but slightly less than we had projected.

Via Talk Markets · February 13, 2026

Gold and silver are in an intermediate correction, with sentiment and technicals suggesting more downside before a durable bottom. The best buying opportunity may come on a 200-day MA test, while miners show improving breadth strength.

Via Talk Markets · February 13, 2026

With Supermicro facing margin pressure and NVIDIA offering far stronger profitability metrics, could NVDA now be the better investment? Let’s take a closer look...

Via Talk Markets · February 13, 2026

In this video lesson, I review the overall market, the recent earnings winners that are on my radar, and review two new long positions for Tuesday's session.

Via Talk Markets · February 13, 2026

Pinterest Inc crashed more than 20% this morning after reporting a “disappointing” Q4 and offering current-quarter guidance that suggested things aren’t expected to improve anytime soon.

Via Talk Markets · February 13, 2026

Tesla stock was higher on Friday, a notable divergence as Big Tech led a sharp selloff with investors debating whether the AI spending boom is starting to pressure near-term profits.

Via Talk Markets · February 13, 2026

This article discusses US Core CPI hitting economist consensus in January data, showing core inflation trends and divergences in food price components, with implications for ongoing inflation dynamics.

Via Talk Markets · February 13, 2026

The article compares IALT, a new multi-strategy ETF, to BDMIX and DIY portfolios, examines volatility trade-offs, convexity gaps, and highlights the need to question AI-driven analysis.

Via Talk Markets · February 13, 2026

We’re seeing a rebound in the precious metals on Friday, as the gold price is once again back over the $5,000 per ounce mark, while the silver futures are up $2.21 to $77.89.

Via Talk Markets · February 13, 2026

Walmart is expected to report $0.73 in EPS on $189.9 billion in revenues, representing year-over-year changes of +10.6% and +5.2%, respectively.

Via Talk Markets · February 13, 2026

When companies with very different business models begin investing in similar ways, it reflects a shared expectation about future demand. In this case, demand for AI computing power is pushing technology back toward infrastructure.

Via Talk Markets · February 13, 2026

Gold holds above $5,000 after a sharp selloff and rebound, while silver suffers an extreme intraday collapse and the media declares a “silver bubble” — missing the bigger picture: a historic breakout and a new base forming.

Via Talk Markets · February 13, 2026

Nasty set of red candlesticks painted the market, but most of these occurred within the context of trading ranges.

Via Talk Markets · February 13, 2026

U.S. trade officials are finally recognizing that tariffs on essential metal products are hurting manufacturers and ultimately consumers.

Via Talk Markets · February 13, 2026

This week’s market narrative revolved around three intersecting forces: the scale of AI capital investment, macroeconomic recalibration of Fed policy, and crypto-driven liquidity swings.

Via Talk Markets · February 13, 2026

The S&P 500 just closed at 6,850. That puts it right on the bottom of a range it has traded inside for months.

Via Talk Markets · February 13, 2026

The Dollar bounced around, but could not take back the 97 handle.

Via Talk Markets · February 13, 2026

Silver climbs to $77.20 after softer US CPI boosts expectations of Fed easing.

Via Talk Markets · February 13, 2026

2025 was a really good year for T-Mobile: it led Verizon and AT&T on postpaid growth, new accounts, and fixed wireless.

Via Talk Markets · February 13, 2026

The near-term path is disinflationary, but the macro is now clearly inflationary.

Via Talk Markets · February 13, 2026

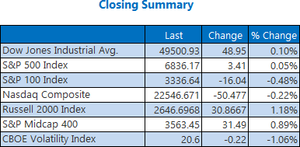

Stocks closed mixed on Friday, as investors unpacked this morning's soft inflation data.

Via Talk Markets · February 13, 2026

The global AI arms race is no longer just about software. It’s becoming a battle over energy, infrastructure, and space.

Via Talk Markets · February 13, 2026

Crude oil is at a key inflection point, with prices likely to surge on war escalation or fall sharply if peace negotiations succeed.

Via Talk Markets · February 13, 2026

We discuss the shift away from globalization towards nationalism by the world's major countries.

Via Talk Markets · February 13, 2026

An analysis and commentary on the financial markets.

Via Talk Markets · February 13, 2026

This TACO was expected, and long overdue. Steel and especially aluminum tariffs are very damaging.

Via Talk Markets · February 13, 2026

The world is grappling with a massive copper shortage that's intensifying rapidly, driven by surging demand from AI data centers amid shrinking supplies.

Via Talk Markets · February 13, 2026