Beverage company Keurig Dr Pepper (NASDAQ:KDP) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 10.7% year on year to $4.31 billion. Its non-GAAP profit of $0.54 per share was in line with analysts’ consensus estimates.

Is now the time to buy Keurig Dr Pepper? Find out by accessing our full research report, it’s free for active Edge members.

Keurig Dr Pepper (KDP) Q3 CY2025 Highlights:

- Revenue: $4.31 billion vs analyst estimates of $4.15 billion (10.7% year-on-year growth, 3.8% beat)

- Adjusted EPS: $0.54 vs analyst estimates of $0.54 (in line)

- Operating Margin: 23.1%, in line with the same quarter last year

- Free Cash Flow Margin: 12.6%, similar to the same quarter last year

- Sales Volumes rose 6.4% year on year (4% in the same quarter last year)

- Market Capitalization: $36.9 billion

Commenting on the quarter, CEO Tim Cofer stated, "We are pleased with our third quarter results, which demonstrated robust growth in U.S. Refreshment Beverages and encouraging sequential progress in U.S. Coffee. Strong innovation and in-market execution drove market share gains across key categories, with sales momentum, along with disciplined actions to offset inflationary pressures, contributing to solid earnings and free cash flow growth. We are focused on sustaining our base business strength while also thoughtfully preparing for the transformation ahead as we first acquire and integrate JDE Peet's and subsequently separate into two, advantaged pure-play companies."

Company Overview

Born out of a 2018 merger between Keurig Green Mountain and Dr Pepper Snapple, Keurig Dr Pepper (NASDAQ:KDP) is a consumer staples powerhouse boasting a portfolio of beverages including sodas, coffees, and juices.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $16.17 billion in revenue over the past 12 months, Keurig Dr Pepper is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth. To accelerate sales, Keurig Dr Pepper likely needs to optimize its pricing or lean into new products and international expansion.

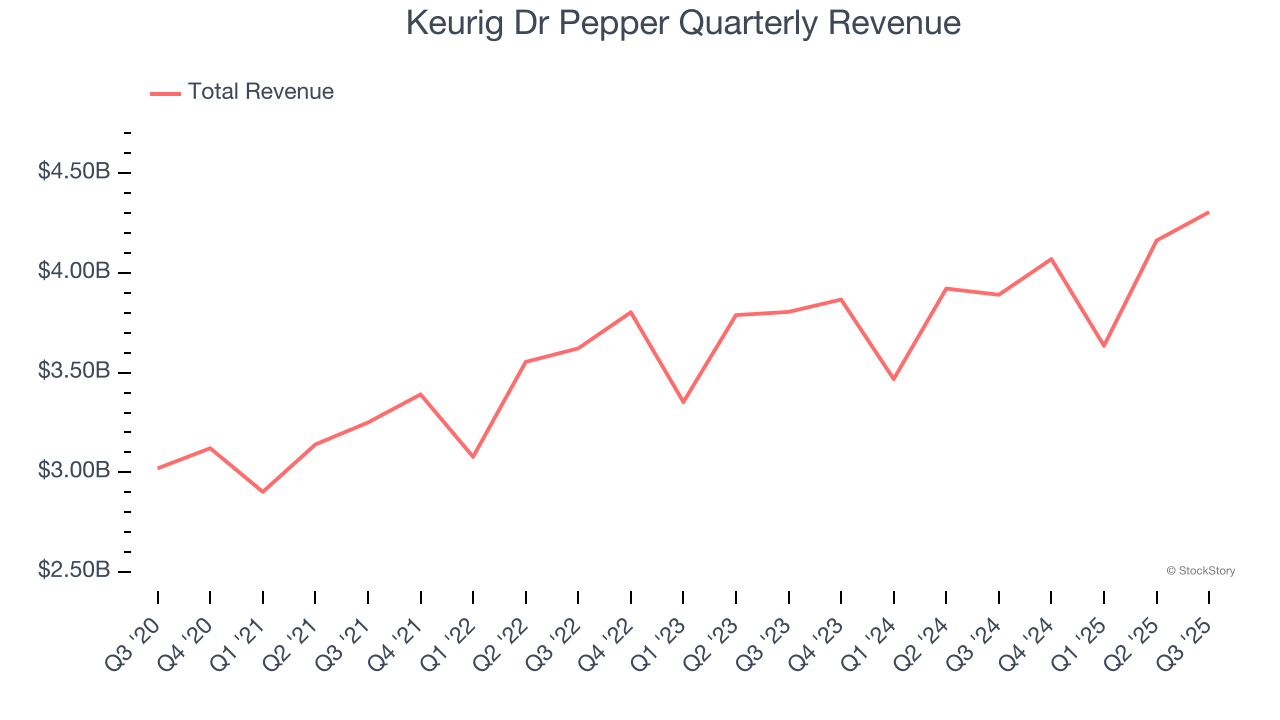

As you can see below, Keurig Dr Pepper’s 5.8% annualized revenue growth over the last three years was mediocre, but to its credit, consumers bought more of its products.

This quarter, Keurig Dr Pepper reported year-on-year revenue growth of 10.7%, and its $4.31 billion of revenue exceeded Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Volume Growth

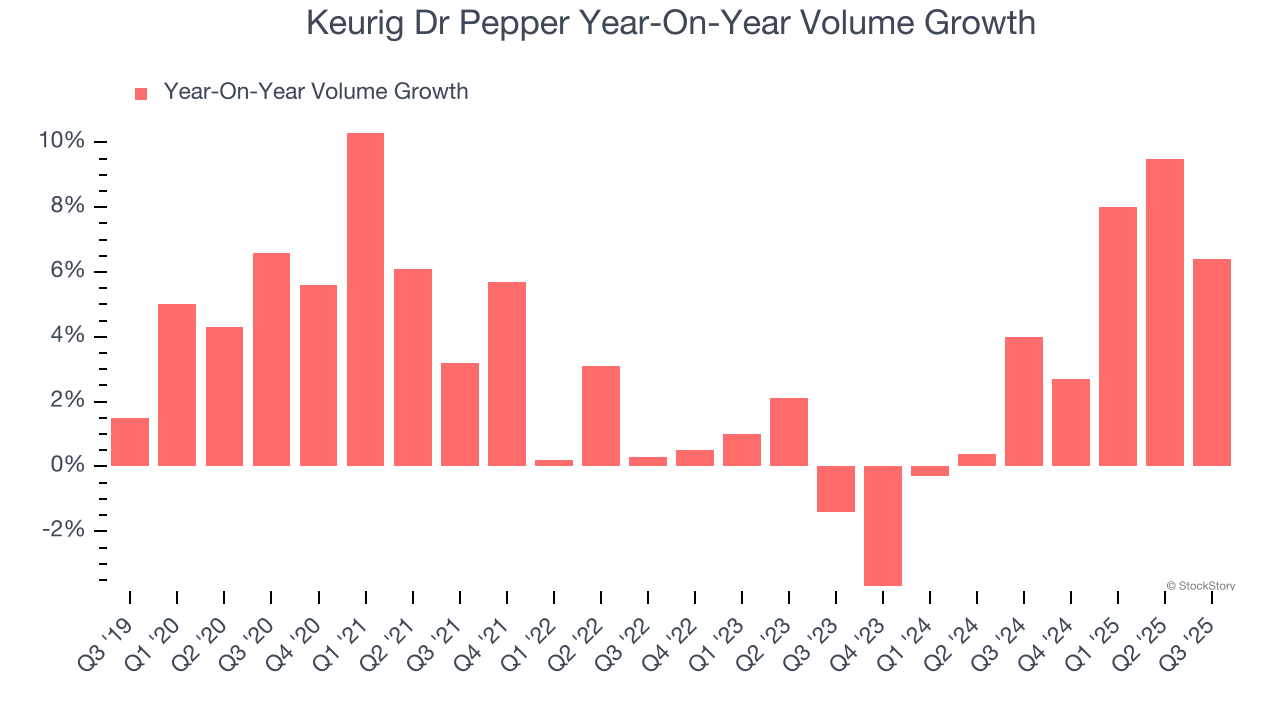

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Keurig Dr Pepper’s average quarterly volume growth was a healthy 3.4% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Keurig Dr Pepper’s Q3 2025, sales volumes jumped 6.4% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from Keurig Dr Pepper’s Q3 Results

We enjoyed seeing Keurig Dr Pepper beat analysts’ revenue expectations this quarter. On the other hand, its gross margin slightly missed. Overall, this print had some key positives. The stock traded up 3.6% to $28.15 immediately following the results.

Indeed, Keurig Dr Pepper had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.