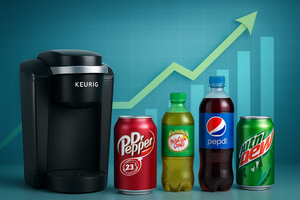

Keurig Dr Pepper Inc. - Common Stock (KDP)

29.13

-0.56 (-1.89%)

NASDAQ · Last Trade: Feb 18th, 2:46 AM EST

Detailed Quote

| Previous Close | 29.69 |

|---|---|

| Open | 29.75 |

| Bid | 28.98 |

| Ask | 29.59 |

| Day's Range | 28.88 - 29.91 |

| 52 Week Range | 25.03 - 36.12 |

| Volume | 10,660,283 |

| Market Cap | 41.29B |

| PE Ratio (TTM) | 25.11 |

| EPS (TTM) | 1.2 |

| Dividend & Yield | 0.9200 (3.16%) |

| 1 Month Average Volume | 10,907,169 |

Chart

About Keurig Dr Pepper Inc. - Common Stock (KDP)

Keurig Dr Pepper is a leading beverage company that specializes in the production and distribution of a diverse portfolio of soft drinks, flavored waters, and coffee products. With a strong emphasis on convenience, the company is well-known for its innovative single-serve coffee machines and a wide array of beverage brands, catering to various consumer preferences. The company's offerings include both popular national brands and niche products, reflecting its commitment to meeting the evolving tastes of consumers across different markets. Additionally, Keurig Dr Pepper focuses on sustainability initiatives, aiming to reduce environmental impact while enhancing the overall customer experience through its products and services. Read More

News & Press Releases

As investors evaluate beverage stocks for 2026, a combination of global cash-flow leaders and emerging functional beverage platforms is drawing increased attention. Industry dynamics across nonalcoholic ready-to-drink (NARTD) beverages, energy drinks, premium coffee, hydration, and cognitive health products are reshaping competitive positioning among large-cap and small-cap beverage companies.

Via AB Newswire · February 17, 2026

A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance.

Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

Via StockStory · February 12, 2026

ATLANTA — Shares of The Coca-Cola Company (NYSE: KO) faced a rare pullback on Tuesday, sliding 1.4% as the beverage giant reported fourth-quarter 2025 earnings that left investors craving more. While the company maintained its status as a cornerstone of the consumer staples sector, a combination of missed revenue targets

Via MarketMinute · February 10, 2026

Trump’s Food Tariff Cut Likely To Trim Import Costs For Hershey, Dr. Pepper, Vita Coco, Analyst Saysstocktwits.com

Via Stocktwits · November 16, 2025

Date: February 10, 2026 Introduction As of February 10, 2026, The Coca-Cola Company (NYSE: KO) stands at a historic crossroads. For over a century, the Atlanta-based behemoth has served as the ultimate "defensive" play for global investors—a bastion of stability through recessions, world wars, and technological revolutions. Today, the company is navigating a profound transformation. [...]

Via Finterra · February 10, 2026

In a climate of heightened economic uncertainty and legislative gridlock, The Coca-Cola Company (NYSE: KO) has emerged as a beacon of stability for the broader market. Shares of the beverage titan climbed to a historic record high of $79.03 on February 6, 2026, marking a significant milestone just days

Via MarketMinute · February 9, 2026

Large-cap stocks are known for their staying power and ability to weather market storms better than smaller competitors.

However, their sheer size makes it more challenging to maintain high growth rates as they’ve already captured significant portions of their markets.

Via StockStory · January 29, 2026

The S&P 500 (^GSPC) is home to the biggest and most well-known companies in the market, making it a go-to index for investors seeking stability.

But not all large-cap stocks are created equal - some are struggling with slowing growth, declining margins, or increased competition.

Via StockStory · January 27, 2026

Over the past six months, Keurig Dr Pepper’s stock price fell to $27.76. Shareholders have lost 15.8% of their capital, which is disappointing considering the S&P 500 has climbed by 8.2%. This may have investors wondering how to approach the situation.

Via StockStory · January 25, 2026

As of January 23, 2026, the beverage landscape is undergoing a tectonic shift, and at the center of this transformation is Keurig Dr Pepper (NASDAQ: KDP). Once viewed primarily as a stable, cash-flow-heavy play on morning coffee and legacy sodas, KDP has reinvented itself into an aggressive, high-growth competitor in the functional beverage and energy [...]

Via Finterra · January 23, 2026

ISSUED ON BEHALF OF DOSEOLOGY SCIENCES INC.

By Equity Insider · Via GlobeNewswire · January 19, 2026

As the financial markets open for the 2026 calendar year, Dutch Bros Inc. (NYSE: BROS) is capturing the attention of technical analysts and growth investors alike. The Oregon-based drive-thru coffee titan recently received a significant Relative Strength (RS) Rating upgrade from 70 to 75, signaling that the stock is now

Via MarketMinute · January 2, 2026

As of January 1, 2026, the energy drink landscape has undergone a seismic shift, moving away from the high-octane, extreme-sports branding of the early 2000s toward a "Better-For-You" (BFY) functional era. At the center of this transformation is Celsius Holdings (Nasdaq: CELH), which has officially transitioned from a high-growth disruptor

Via MarketMinute · January 1, 2026

Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages.

Just because a business is in the green today doesn’t mean it will thrive tomorrow.

Via StockStory · December 29, 2025

Consumer staples stocks are solid insurance policies in frothy markets ripe for corrections. On the other hand, they usually underperform during bull runs,

and this paradigm has rung true over the past six months as the sector’s -9.1% decline paled in comparison to the S&P 500’s 11.7% gain.

Via StockStory · December 28, 2025

The Nasdaq 100 (^NDX) is known for housing some of the most innovative and fastest-growing companies in the market.

But not every stock in the index is a winner - some are struggling with slowing growth, increasing competition, or unsustainable valuations.

Via StockStory · December 18, 2025

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at beverages, alcohol, and tobacco stocks, starting with Keurig Dr Pepper (NASDAQ:KDP).

Via StockStory · December 16, 2025

Keurig Dr Pepper (NASDAQ: KDP) announced today, December 9, 2025, that its Board of Directors has declared a regular quarterly cash dividend of $0.23 per share of common stock. This move underscores the company's commitment to returning value to shareholders and signals robust financial health amidst a dynamic consumer

Via MarketMinute · December 9, 2025

As the trading day of December 9, 2025, draws to a close, beverage giant Coca-Cola (NYSE: KO) finds itself in the spotlight not for effervescent gains, but for a more subdued performance, positioning it as a bottom mover in today's market. Despite a generally optimistic outlook from many analysts, underlying

Via MarketMinute · December 9, 2025

An underperforming beverages business and an eventually slowing snacks division have put PepsiCo in the spotlight this year, with Elliott Investment Management asking the company to course-correct.

Via Stocktwits · December 9, 2025

Why did Denny's stock soar nearly 60% in November? Here's what Denny's investors and restaurant guests need to know.

Via The Motley Fool · December 2, 2025

As tariffs rattle coffee markets and CEO overhauls reshape strategy, food giants are selling premium café brands while others bulk up through billion-dollar deals.

Via Stocktwits · December 2, 2025

Value investing has created more billionaires than any other strategy, like Warren Buffett, who built his fortune by purchasing wonderful businesses at reasonable prices.

But these hidden gems are few and far between - many stocks that appear cheap often stay that way because they face structural issues.

Via StockStory · November 20, 2025

Low-volatility stocks may offer stability, but that often comes at the cost of slower growth and the upside potential of more dynamic companies.

Via StockStory · November 14, 2025

Sao Paulo, Brazil – November 13, 2025 – The global coffee market is currently experiencing significant turbulence, with coffee futures on the rise due to a severe and prolonged drought in Brazil, the world's largest coffee producer. This climatic challenge, coupled with other market dynamics, is having immediate and far-reaching implications for

Via MarketMinute · November 13, 2025