Sanofi - American Depositary Shares (SNY)

48.58

+0.23 (0.47%)

NASDAQ · Last Trade: Feb 27th, 3:25 PM EST

As of today, February 27, 2026, the biotech sector is witnessing a dramatic reappraisal of one of its most storied pandemic-era players. Novavax (NASDAQ: NVAX) has surged 17.4% following the release of its fourth-quarter 2025 financial results, a move that signals investor confidence in the company’s radical transformation. Once teetering on the edge of a [...]

Via Finterra · February 27, 2026

On February 2, 2026, AstraZeneca PLC (NYSE: AZN) officially rang the opening bell at the New York Stock Exchange, marking the completion of its high-profile transition from the Nasdaq. The move signals a major structural shift for the UK-based pharmaceutical leader, as it moves away from its long-standing American Depositary

Via MarketMinute · February 26, 2026

In a landmark decision for the cardiovascular treatment landscape, the European Commission (EC) officially granted marketing authorization to Cytokinetics, Inc. (Nasdaq: CYTK) on February 17, 2026, for its innovative cardiac drug, MYQORZO (aficamten). The approval clears the way for the treatment of adult patients suffering from symptomatic obstructive hypertrophic cardiomyopathy

Via MarketMinute · February 23, 2026

Disc Medicine, Sanofi, Eli Lilly Shares Slip On Reports Of FDA Increasing Review Time For Drugs Granted Priority Review Vouchersstocktwits.com

Via Stocktwits · January 15, 2026

This player's pipeline should keep growth going over the long run.

Via The Motley Fool · February 21, 2026

As of February 17, 2026, Moderna, Inc. (NASDAQ:MRNA) finds itself at a pivotal crossroads in its corporate evolution. Long defined by its meteoric rise during the COVID-19 pandemic, the Cambridge-based biotechnology pioneer is now fighting to prove that its messenger RNA (mRNA) platform is a "one-hit wonder" no more. The company has dominated recent financial [...]

Via Finterra · February 17, 2026

In a move that could reshape the multi-billion-dollar retinal disease market, French pharmaceutical giant Sanofi (NASDAQ: SNY) has reportedly returned to the negotiating table with a significantly "sweetened" revised bid for Ocular Therapeutix (NASDAQ: OCUL). The updated offer comes at a high-stakes moment for the biotech industry, as Ocular Therapeutix

Via MarketMinute · February 16, 2026

As of February 12, 2026, Alnylam Pharmaceuticals (NASDAQ: ALNY) has officially transcended its status as a high-potential biotech and entered the pantheon of global pharmaceutical powerhouses. Known as the pioneer of RNA interference (RNAi) technology, Alnylam has successfully transitioned from a research-heavy enterprise to a fully integrated, profitable commercial leader. With the recent expansion of [...]

Via Finterra · February 12, 2026

Shares of Moderna, Inc. (NASDAQ: MRNA) fell 3.5% on February 12, 2026, as investors continued to digest the fallout from a rare and unexpected regulatory setback. The U.S. Food and Drug Administration (FDA) issued a Refusal-to-File (RTF) letter regarding the company’s Biologics License Application (BLA) for its

Via MarketMinute · February 12, 2026

Everus Construction Group delivers utility construction and specialty services across the Midwest and key urban markets.

Via The Motley Fool · January 29, 2026

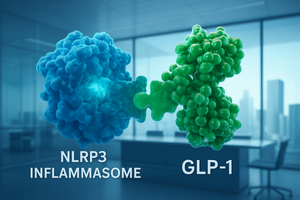

In a strategic move to solidify its dominance in the burgeoning field of oral anti-inflammatories, Eli Lilly and Company (NYSE:LLY) announced on January 7, 2026, a definitive agreement to acquire Ventyx Biosciences (NASDAQ:VTYX) for approximately $1.2 billion. The all-cash deal, valued at $14.00 per share, marks

Via MarketMinute · January 28, 2026

In a decisive move to solidify its leadership in the next generation of chronic inflammation and cardiometabolic treatments, Eli Lilly and Company (NYSE: LLY) announced the acquisition of Ventyx Biosciences (NASDAQ: VTYX) for approximately $1.2 billion. The all-cash deal, announced in early January 2026, values Ventyx at $14.00

Via MarketMinute · January 27, 2026

Retail sentiment on Stocktwits for SPY and QQQ remained ‘bearish’.

Via Stocktwits · January 23, 2026

LONDON — January 20, 2026 — In a milestone moment for global capital markets, pharmaceutical giant AstraZeneca (NYSE: AZN) has officially filed its formal notice of voluntary withdrawal from the Nasdaq Stock Market today. The move marks the final countdown for one of the most significant listing migrations in recent history, as

Via MarketMinute · January 20, 2026

In a bold strategic opening to the 2026 fiscal year, pharmaceutical giant GSK (NYSE:GSK) has announced a definitive agreement to acquire RAPT Therapeutics (Nasdaq:RAPT) for approximately $2.2 billion. The deal, confirmed on January 20, 2026, represents a significant escalation in the multi-billion dollar race to dominate the

Via MarketMinute · January 20, 2026

In the opening weeks of 2026, the artificial intelligence industry has moved beyond general-purpose models to a high-stakes "verticalization" phase, with healthcare emerging as the primary battleground. Within days of each other, OpenAI and Anthropic have both unveiled dedicated, HIPAA-compliant clinical suites designed to transform how hospitals, insurers, and life sciences companies operate. These launches [...]

Via TokenRing AI · January 19, 2026

On January 11, 2026, Anthropic, the AI safety and research company, officially unveiled its most significant industry-specific expansion to date: specialized healthcare and life sciences tiers for its flagship Claude 4.5 model family. These new offerings, "Claude for Healthcare" and "Claude for Life Sciences," represent a strategic pivot toward vertical AI solutions, aiming to integrate [...]

Via TokenRing AI · January 19, 2026

As of January 16, 2026, Moderna, Inc. (NASDAQ: MRNA) stands at a critical crossroads. Once the poster child for the biotechnology industry’s rapid response to a global pandemic, the Cambridge-based pioneer is currently undergoing a painful but essential metamorphosis. The "mRNA 1.0" era, defined by the singular success of its COVID-19 vaccine, has effectively ended. [...]

Via Finterra · January 16, 2026

In a bold move to solidify its dominance in the cardiometabolic market, Eli Lilly and Company (NYSE:LLY) announced on January 7, 2026, that it has entered into a definitive agreement to acquire Ventyx Biosciences (NASDAQ:VTYX) for approximately $1.2 billion. The all-cash transaction, priced at $14.00 per

Via MarketMinute · January 15, 2026

French pharmaceutical giant Sanofi is preparing an offer to acquire the American biopharmaceutical firm, according to a report by French publication La Lettre.

Via Stocktwits · January 15, 2026

On January 11, 2026, Anthropic officially unveiled Claude for Healthcare, a specialized suite of artificial intelligence tools designed to bridge the gap between frontier large language models and the highly regulated medical industry. Announced during the opening of the J.P. Morgan Healthcare Conference, the platform represents a strategic pivot for Anthropic, moving beyond general-purpose AI [...]

Via TokenRing AI · January 12, 2026

Olema Pharmaceuticals (NASDAQ:OLMA) has become the latest focal point of biotech volatility and executive opportunism. Following a staggering 300% surge in its share price over the past year—fueled by a "rising tide" effect in the breast cancer treatment market—top insiders have begun offloading significant portions of their

Via MarketMinute · January 9, 2026

MoonLake Immunotherapeutics (NASDAQ: MLTX) shares have experienced a dramatic resurgence this week, climbing over 40% following a pivotal regulatory update that has effectively cleared the path for its lead drug candidate, sonelokimab. The Swiss biotech company announced on January 8, 2026, that a successful Type B meeting with the U.

Via MarketMinute · January 9, 2026

In a move that signals the end of an era for independent mRNA pioneers, BioNTech SE (Nasdaq: BNTX) has officially completed its acquisition of longtime rival CureVac N.V. (Nasdaq: CVAC). The finalization of the deal on January 6, 2026, marks the conclusion of a complex multi-stage merger that saw

Via MarketMinute · January 9, 2026

Today’s Date: January 9, 2026 Introduction As we enter the first weeks of 2026, Moderna, Inc. (NASDAQ: MRNA) finds itself at a defining crossroads. Once the poster child for the biotech boom of the early 2020s, the Cambridge-based pioneer has spent the last 24 months attempting to shed its image as a "pandemic-only" play. After [...]

Via PredictStreet · January 9, 2026