Nike, Inc. Common Stock (NKE)

63.13

+2.03 (3.32%)

NYSE · Last Trade: Feb 15th, 11:45 AM EST

Detailed Quote

| Previous Close | 61.10 |

|---|---|

| Open | 61.59 |

| Bid | 62.55 |

| Ask | 63.08 |

| Day's Range | 61.59 - 63.38 |

| 52 Week Range | 52.28 - 82.44 |

| Volume | 20,181,207 |

| Market Cap | 54.00B |

| PE Ratio (TTM) | 37.14 |

| EPS (TTM) | 1.7 |

| Dividend & Yield | 1.640 (2.60%) |

| 1 Month Average Volume | 14,497,896 |

Chart

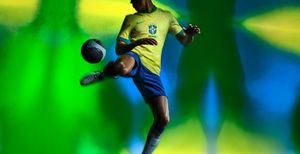

About Nike, Inc. Common Stock (NKE)

This company is a leading global sportswear brand that designs, develops, and markets a wide range of athletic footwear, apparel, and equipment. It is known for its innovative products, high-quality materials, and cutting-edge technology, catering to athletes and fitness enthusiasts across various sports and activities. The brand also emphasizes sustainability and community engagement, often collaborating with athletes, designers, and organizations to promote a healthy lifestyle and social responsibility. Through its extensive retail network and online platforms, the company aims to inspire and empower individuals to pursue their athletic goals. Read More

News & Press Releases

This company's strong brand and renewed focus should help it turn things around.

Via The Motley Fool · February 15, 2026

NIKE, Inc. (NYSE: NKE) announced today that its Board of Directors has declared a quarterly cash dividend of $0.41 per share on the Company’s outstanding Class A and Class B Common Stock payable on April 1, 2026, to shareholders of record at the close of business on March 2, 2026.

By NIKE, Inc. · Via Business Wire · February 13, 2026

The Dow Jones Industrial Average endured a chilling session this Friday, February 13, 2026, dropping 267.77 points, or 0.54%, to close at 49,184.21. The slide marked the second consecutive day of losses for the blue-chip index, following a more severe 669-point tumble on Thursday. What began

Via MarketMinute · February 13, 2026

NIKE INC -CL B (NYSE:NKE) Presents a Compelling Case for Dividend Growth Investorschartmill.com

Via Chartmill · February 7, 2026

As the final results of the Q4 2025 earnings season trickle in this February 12, 2026, the S&P 500 has managed to navigate a treacherous path of high expectations and a tightening monetary narrative. Despite initial fears that high interest rates and a cooling labor market would erode corporate

Via MarketMinute · February 12, 2026

Bonds have been doing a dance over the past year, and they could be set up to outperform stocks in the near future. Here's my investment strategy.

Via Barchart.com · February 12, 2026

As of February 12, 2026, Crocs, Inc. (NASDAQ: CROX) stands as a case study in brand resilience and the "ugly-cool" cultural phenomenon. Once considered a fad destined for the clearance racks of 2008, the Broomfield, Colorado-based footwear giant has evolved into a high-margin, multi-brand powerhouse. However, the investment narrative in early 2026 is no longer [...]

Via Finterra · February 12, 2026

In a striking display of market divergence, the Dow Jones Industrial Average surged to its third consecutive record high on Tuesday, February 10, 2026, momentarily piercing the 50,609 mark intraday. This milestone marks a significant psychological and technical breakthrough for the "blue-chip" index, which has found a second wind

Via MarketMinute · February 11, 2026

The beaten-down consumer discretionary stock trades 64% below its all-time record.

Via The Motley Fool · February 11, 2026

After years of falling sales, cost cuts at Converse may have been inevitable.

Via The Motley Fool · February 9, 2026

Via PRLog · February 9, 2026

According to a report from Bloomberg that cited a memo from Converse’s CEO Aaron Cain, the company is making “difficult decisions” that will include “saying goodbye to friends and teammates.”

Via Stocktwits · February 9, 2026

As the torch burns bright over Milano-Cortina for the 2026 Winter Olympics, the battle for international supremacy is already reaching a fever pitch—not just on the slopes, but in the high-stakes world of prediction markets. Just three days into the official competition, Norway has emerged as a staggering favorite to top the gold medal leaderboard, [...]

Via PredictStreet · February 9, 2026

Nike’s Super Bowl return continues to turn heads, and this year, it partnered with former NFL player Marshawn Lynch for an advertisement congratulating the Seattle Seahawks on clinching the championship.

Via Stocktwits · February 9, 2026

As the ceremonial fires of the XXV Olympic Winter Games flicker in the dual host cities of Milan and Cortina d'Ampezzo, the world’s attention has shifted from the spectacle of the opening ceremony to the high-stakes reality of the podium. On the world’s leading prediction platform, Polymarket, a clear consensus has emerged: Norway is the [...]

Via PredictStreet · February 7, 2026

The United States labor market, long considered the resilient backbone of the post-pandemic economy, showed significant signs of strain in January 2026. A dual-threat of surging corporate layoffs and a sharp contraction in job openings has sent ripples through the financial markets, challenging the "soft landing" narrative that dominated much

Via MarketMinute · February 6, 2026

On February 6, 2026, Under Armour (NYSE: UAA / UA) finds itself at a pivotal crossroads in its thirty-year history. Once the brash upstart that dared to challenge the dominance of industry titans, the Baltimore-based athletic apparel brand has spent the last several years navigating a complex "reset" of its business model. Under the renewed [...]

Via Finterra · February 6, 2026

The Equal Employment Opportunity Commission (EEOC) has sued Nike Inc. in a Missouri federal court on Wednesday.

Via Benzinga · February 5, 2026

Nike Inc. (NKE) shares are up on Wednesday, moving in tandem with broader market trends.

Via Benzinga · February 4, 2026

Market swings can be tough to stomach, and volatile stocks often experience exaggerated moves in both directions.

While many thrive during risk-on environments, many also struggle to maintain investor confidence when the ride gets bumpy.

Via StockStory · February 2, 2026

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at consumer discretionary stocks, starting with Forestar Group (NYSE:FOR).

Via StockStory · February 2, 2026

The United States economy is entering a period of profound uncertainty as the latest labor data paints a picture of a rapidly cooling engine. With initial jobless claims stabilizing at a notable 206,000 for the final week of January and the December jobs report revealing a meager addition of

Via MarketMinute · February 2, 2026

The management teams at these companies are displaying a forward-thinking mentality.

Via The Motley Fool · February 1, 2026

Global entertainment and media company Disney (NYSE:DIS)

will be announcing earnings results this Monday before market open. Here’s what investors should know.

Via StockStory · January 31, 2026

Via MarketBeat · January 31, 2026