Latest News

Evercore ISI sees C.H. Robinson as a rare AI-era winner because its agentic supply chain platform is already turning 30‑plus AI agents loose on real freight tasks, helping it gain share, expand margins, and extend a 28‑year dividend growth streak.

Via Barchart.com · March 4, 2026

American Eagle (AEO) Q4 2025 Earnings Transcript

Via The Motley Fool · March 4, 2026

Hudson Technologies (HDSN) Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Could Oddity be the next breakout stock in the cosmetics and wellness sector? Join us as we evaluate its strengths, weaknesses, and future potential.

Via The Motley Fool · March 4, 2026

It's starting work on a very lucrative project.

Via The Motley Fool · March 4, 2026

Ooma (OOMA) Q4 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

OmniAb Inc (NASDAQ:OABI) Reports Q4 and Full-Year 2025 Earnings Miss, Provides 2026 Outlookchartmill.com

Via Chartmill · March 4, 2026

Janus International Group Inc (NYSE:JBI) Reports Mixed Q4 Results with Revenue Beat and EPS Misschartmill.com

Via Chartmill · March 4, 2026

Viemed Healthcare Inc (NASDAQ:VMD) Shares Fall After Q4 Revenue Miss and Cautious 2026 Outlookchartmill.com

Via Chartmill · March 4, 2026

Grocery Outlet (NASDAQ:GO) Plummets 22% on Weak Comps, Impairments, and Cautious Outlookchartmill.com

Via Chartmill · March 4, 2026

Not understanding it could cost you.

Via The Motley Fool · March 4, 2026

Broadcom (AVGO) Q1 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

For the full year 2027, the company expects total revenue of $3.17 billion to $3.19 billion, in line with an estimated $3.17 billion, and adjusted and diluted net income per share of $3.74 to $3.82, beating an estimate of $3.67.

Via Stocktwits · March 4, 2026

Okta (OKTA) Q4 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Veeva (VEEV) Q4 2026 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

These top Canadian dividend stocks provide the sort of total return upside so many investors are looking for. Here's why they look like strong buys right now.

Via The Motley Fool · March 4, 2026

Business Insider reported the layoffs on Wednesday, citing a message from Amazon Robotics VP Scott Dresser.

Via Stocktwits · March 4, 2026

StubHub (STUB) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

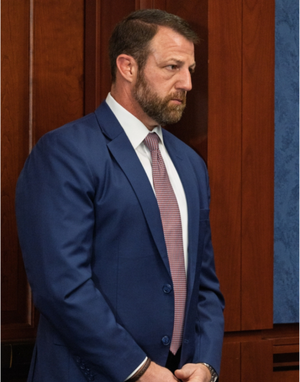

Sen. Markwayne Mullin has been buying shares of smaller companies in recent months. Here are his latest transactions and why one stock is catching attention.

Via Benzinga · March 4, 2026

PagSeguro (PAGS) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Buffett has proven his investing skills over the long term.

Via The Motley Fool · March 4, 2026

Via Benzinga · March 4, 2026

Perhaps the market isn't looking forward enough on this one.

Via The Motley Fool · March 4, 2026

Stem (STEM) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

TriplePoint (TPVG) Earnings Call Transcript

Via The Motley Fool · March 4, 2026

ChargePoint (CHPT) Q4 2026 Earnings Transcript

Via The Motley Fool · March 4, 2026

SES AI (SES) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

This clinical-stage biotech develops targeted cancer therapies, leveraging strategic partnerships and a differentiated oncology pipeline.

Via The Motley Fool · March 4, 2026

Sirius XM provides subscription satellite radio and digital audio services to consumers, automakers, and commercial partners across the U.S.

Via The Motley Fool · March 4, 2026

Cracker Barrel (CBRL) Q2 2026 Earnings Transcript

Via The Motley Fool · March 4, 2026

Via Benzinga · March 4, 2026

Alto (ALTO) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 4, 2026

Nvidia has become the bellwether for the tech industry.

Via The Motley Fool · March 4, 2026

A surplus of cash can mean financial stability, but it can also indicate a reluctance (or inability) to invest in growth. Some of these companies also face c...

Via StockStory · March 4, 2026

The best-performing stocks typically have robust sales growth, increasing margins, and rising returns on capital, and those that can maintain this trifecta y...

Via StockStory · March 4, 2026

A cash-heavy balance sheet is often a sign of strength, but not always. Some companies avoid debt because they have weak business models, limited expansion o...

Via StockStory · March 4, 2026

The animation specialist's final quarter of 2025 left much to be desired.

Via The Motley Fool · March 4, 2026

While profitability is essential, it doesn’t guarantee long-term success. Some companies that rest on their margins will lose ground as competition intensifi...

Via StockStory · March 4, 2026

Banks use their capital and expertise to help businesses grow while offering consumers essential financial products like mortgages and credit cards. Still, i...

Via StockStory · March 4, 2026

The stocks in this article have caught Wall Street’s attention in a big way, with price targets implying returns above 20%. But investors should take these f...

Via StockStory · March 4, 2026

While the S&P 500 (^GSPC) includes industry leaders, not every stock in the index is a winner. Some companies are past their prime, weighed down by poor exec...

Via StockStory · March 4, 2026

Wall Street has set ambitious price targets for the stocks in this article. While this suggests attractive upside potential, it’s important to remain skeptic...

Via StockStory · March 4, 2026

Generating cash is essential for any business, but not all cash-rich companies are great investments. Some produce plenty of cash but fail to allocate it eff...

Via StockStory · March 4, 2026

While the S&P 500 (^GSPC) includes industry leaders, not every stock in the index is a winner. Some companies are past their prime, weighed down by poor exec...

Via StockStory · March 4, 2026

Small-cap stocks can be incredibly lucrative investments because their lack of analyst coverage leads to frequent mispricings. However, these businesses (and...

Via StockStory · March 4, 2026

Investors looking for hidden gems should keep an eye on small-cap stocks because they’re frequently overlooked by Wall Street. Many opportunities exist in th...

Via StockStory · March 4, 2026