iShares MSCI South Africa Index Fund (EZA)

66.50

-0.12 (-0.18%)

NYSE · Last Trade: Nov 11th, 3:13 PM EST

Detailed Quote

| Previous Close | 66.62 |

|---|---|

| Open | 66.21 |

| Day's Range | 65.90 - 66.52 |

| 52 Week Range | 39.74 - 67.71 |

| Volume | 57,840 |

| Market Cap | 5.12M |

| Dividend & Yield | 1.252 (1.88%) |

| 1 Month Average Volume | 250,470 |

Chart

News & Press Releases

Trump's 25% tariffs on Japan and South Korea sent the yen lower and hammered major Asia-focused ETFs on Monday.

Via Benzinga · July 7, 2025

Donald Trump's sweeping tariff announcement, speculators who wagered on a chain reaction of trade retaliation may soon cash in the big prize.

Via Benzinga · April 3, 2025

Hong Kong (EWH) is trading over 3 standard deviations above its 50-DMA for the country's most overbought reading since October.

Via Talk Markets · March 6, 2025

Since the elections a little over two and a half months ago, the S&P 500 (SPY) has risen 5.42% through today. That's better than any of the other key country ETFs.

Via Talk Markets · January 21, 2025

South Korea (EWY) is by far the worst performer today and it is also now the only one trading at a 52-week low too.

Via Talk Markets · December 3, 2024

Chinese equities, as proxied by the MSCI China ETF MCHI, are now up close to 26% since September 13th.

Via Talk Markets · September 30, 2024

The weakening U.S. dollar is prompting increased capital investment into emerging markets, signaling a potential shift in global economic dynamics.

Via MarketBeat · September 5, 2024

South Africa is renowned for its developed and diversified mining industry. We put the country ETF EZA on our radar as mining output has declined significantly since the 1970s due to various factors.

Via Talk Markets · June 18, 2024

Equities in the U.S. have gotten off to a weak start this month with the S&P 500 (SPY) down modestly over the past couple of sessions.

Via Talk Markets · June 4, 2024

INDA ETF is up 16.3% over the past year, followed by the iShares MSCI Brazil ETF at 12.9%; Russian, Chinese and South African equity lag far behind.

Via Benzinga · January 17, 2024

South Africa’s economy is on a disheartening path.

Via Talk Markets · November 21, 2023

Burton Malkiel, author of the book A Random Walk Down Wall Street, asserted, “The facts suggest that successful market timing is extraordinarily difficult to achieve.”1

Via Talk Markets · August 30, 2023

July was a positive month for the U.S. stock market, but strong gains were also seen in global equity markets, with some countries posting double-digit monthly returns. Notably, the 1% decline in the dollar in July, marking its second consecutive month of losses, provided a boost to numerous emerging markets heavily reliant on the greenback’s cycle.

Via Benzinga · July 31, 2023

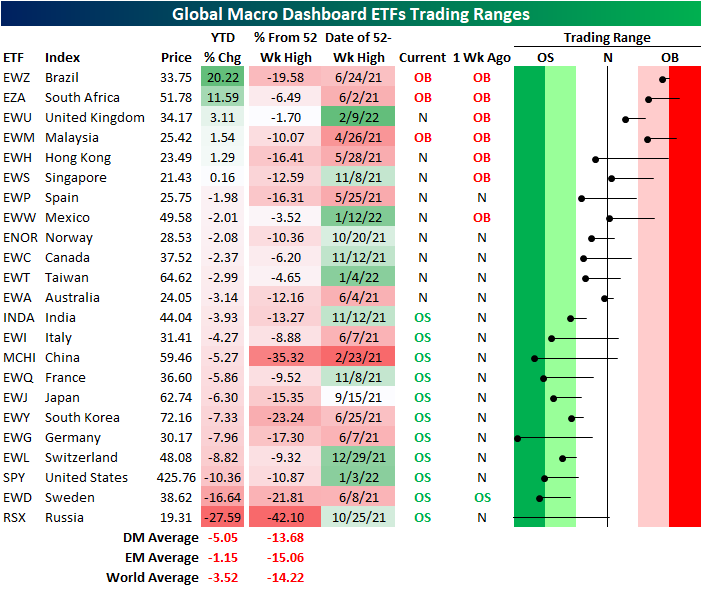

The average country ETF is 4.55% away from a 52-week high after posting a double-digit YTD gain. Based on developed and emerging countries, there has been some divergence.

Via Talk Markets · July 26, 2023

If you’re worried Chinese stocks have come too far, too fast, here are other emerging markets ETFs to consider for 2023.

Via InvestorPlace · January 24, 2023

With 2022 drawing to a close, there are only two countries that are currently in the green for the year: Brazil (EWZ) and Mexico (EWW).

Via Talk Markets · December 28, 2022

For most major global equity markets, at some point this Fall a 52-week low has been put in place, with significant rallies since then.

Via Talk Markets · December 1, 2022

Relative to the rest of the world, the S&P 500’s one-week performance has actually been middling at just over 5%.

Via Talk Markets · November 14, 2022

RSX is now down 42% from its 52-week high setback in October and is down 27.59% year to date.

Via Talk Markets · February 23, 2022

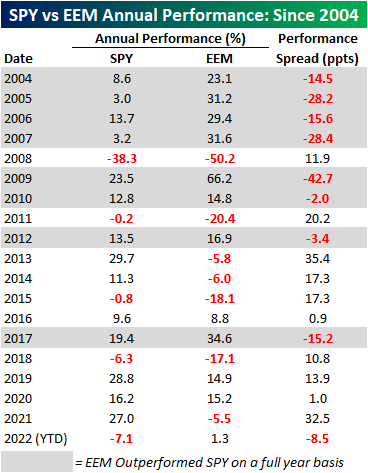

So far this year, SPY has traded down by 7.1% while EEM has gained 1.3%, thus resulting in a performance spread of 8.5 ppts.

Via Talk Markets · February 17, 2022

A look at the ETFs tracking the stock markets of 22 major global economies and their performance YTD, since their 52-week high

Via Talk Markets · January 26, 2022

If you're thinking about some of the best country-specific ETFs to buy for 2022, here are seven that ought to deliver for investors.

Via InvestorPlace · January 7, 2022

It may have been a shortened session in the US, but equities took a big hit around the globe today.

Via Talk Markets · November 26, 2021

Looking across the various ETFs tracking the stock markets, by far the best performer in the month of August was India (INDA) which rallied 8.75%.

Via Talk Markets · September 1, 2021