Vanguard Industrials ETF (VIS)

295.36

-0.52 (-0.18%)

NYSE · Last Trade: Nov 10th, 11:37 AM EST

Detailed Quote

| Previous Close | 295.88 |

|---|---|

| Open | 297.84 |

| Day's Range | 294.80 - 298.48 |

| 52 Week Range | 213.26 - 303.51 |

| Volume | 12,093 |

| Market Cap | 61.80M |

| Dividend & Yield | 2.928 (0.99%) |

| 1 Month Average Volume | 58,356 |

Chart

News & Press Releases

Honeywell (NASDAQ: HON) is considering strategic options for its logistics-focused business units, as part of its restructuring to focus on automation. CEO Vimal Kapur says this aligns with their goal of concentrating on industrial, process, and building automation. The review process will not affect the planned spin-offs of other divisions. Jim Masso has been appointed to lead the process automation division. HON shares declined 0.24% premarket. Lockheed Martin leads in capital efficiency in the defense sector, but market response is lackluster.

Via Benzinga · July 8, 2025

Via The Motley Fool · July 5, 2025

Via The Motley Fool · January 30, 2025

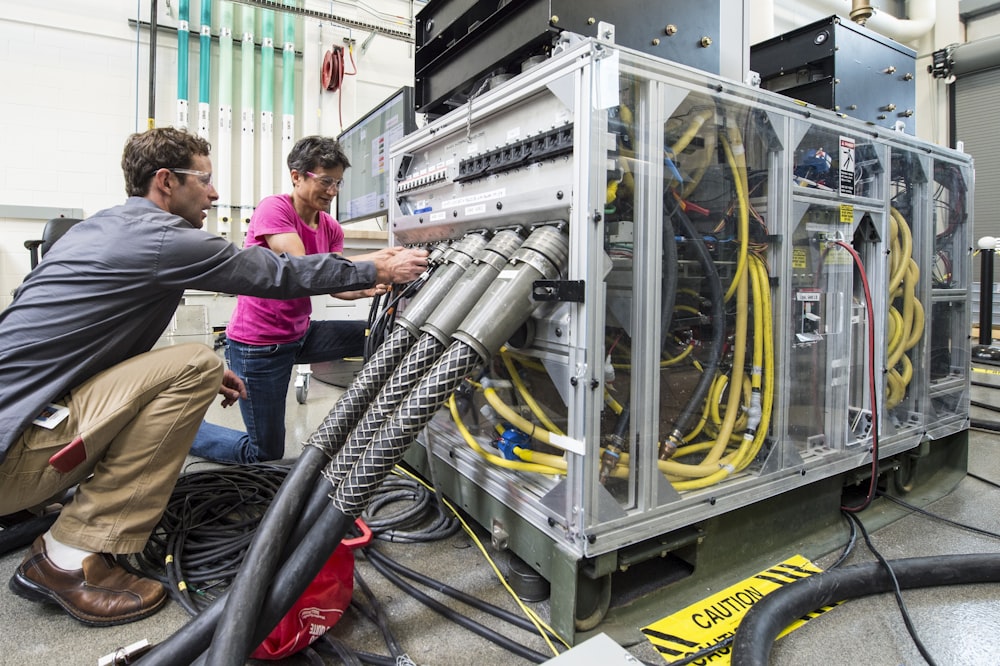

The two will collaborate to develop NuSun, NuCube’s small, modular microreactor, which is intended to power industrial and data-center applications.

Via Stocktwits · January 15, 2025

Maganomics is Trump's economic plan to boost domestic manufacturing, attracting investors and causing divided opinions. ETFs heavy in manufacturing may benefit.

Via Benzinga · January 13, 2025

The year of milestones, 2024, has seen an unperturbed rise in the bull market, we recap 2024's landmark junctures in the U.S. stock market.

Via Benzinga · December 25, 2024

Investors continue to gravitate toward megacap growth stocks that show no signs of slowing down.

Via The Motley Fool · November 12, 2024

There is a classification system that separates the +5,000 publicly traded U.S. stocks into 11 sectors representing key areas of the economy. Choosing the right sectors can be a challenge so this article should help with that.

Via Talk Markets · June 27, 2024

The communications sector could have more room to run, given its reasonable valuation and growth potential.

Via The Motley Fool · May 30, 2024

In a stock picker’s market, opportunities within underdog sectors can prove ideal for growth-hungry investors.

Via InvestorPlace · April 18, 2024

Insights on investment opportunities in the economy from a Benzinga interview with Michael Sayers, including $1 trillion in infrastructure spending and potential growth in technology and clean energy sectors.

Via Benzinga · April 16, 2024

Parking some of your dollars in high-performing sector ETFs may juice your portfolio's returns.

Via The Motley Fool · March 24, 2024

According to Fidelity's sector managers, the most promising opportunities for 2024 may lie in Materials, Industrials, and Consumer Discretionary sectors.

Via Benzinga · January 12, 2024

The world's biggest economy expanded at the fastest pace in nearly two years, with GDP rising 4.9% annually, more than twice from the 2.1% growth recorded in the second quarter. Many ETFs will likely benefit from these solid GDP numbers.

Via Talk Markets · October 28, 2023

With global supply chains easing, and further geopolitical pressures building in the semiconductor industry, these names are sure winners.

Via InvestorPlace · September 10, 2023

Most of the ETFs will likely benefit on solid GDP numbers. Here are five that are expected to outperform.

Via Talk Markets · July 28, 2023

The equity market is beginning to see a “fits-and-starts” recovery amid hopes that the Federal Reserve may soon start to pivot or at least pause in light of a thaw down in inflationary pressure.

Via Benzinga · November 15, 2022

Friday bullish risk on. That said, I'm viewing the move up as a corrective rally in three waves.

Via Talk Markets · September 8, 2022

Investors could follow some strategies that could lead to a winning portfolio during this soft six-month period.

Via Talk Markets · May 4, 2022

Drone ETF Lifts Off on a Busy Day for the Booming Industry (AITX, UAV, DPRO, KTOS, UAVS)

The drone industry is on pace to grow at a staggering rate. Wall Street sharps are well aware of the opportunity. This is why on Wednesday, AdvisorShares an investment firm with assets under management (AUM) of $2 billion unveiled its AdvisorShares Drone Technology ETF (NYSEARCA:UAV), which is a thematic fund that aims to deliver investment exposure to unmanned aerial vehicles (aka drones) and autonomous vehicles.

Via AB Newswire · April 28, 2022

The list includes high dividend paying stocks that are growing at a steady rate, suitable for income-seeking investors.

Via InvestorPlace · April 26, 2022

The industrial sector is expected to remain strong as improving labor market conditions highlights brighter prospects. Against this backdrop, we will take a look at ETFs exposed to the industrial sector.

Via Talk Markets · February 12, 2022

The latest ISM Manufacturing Purchasing Managers' Index (PMI) data for the United States is painting a rosy picture for the industrial sector. The metric rose to 59.9 in August from 59.5 in July and surpassed forecasts of 58.6, per Reuters.

Via Talk Markets · September 5, 2021

The industrial sector, which faced disruption in global supply chains and factory closedowns, is expected to rebound on recovery from the coronavirus-led slump. Against this backdrop, investors can still keep a tab on the following ETFs.

Via Talk Markets · July 17, 2021

Wall Street had a decent run on the bourses in May despite intensifying concerns about the rising inflation levels. The Dow Jones Industrial Average rose 1.9% last month. Moreover, there was a 0.6% increase in the S&P 500 Index during May.

Via Talk Markets · June 2, 2021